How to get an Instant Personal Loan for Home Renovation?

Buying your dream house and keeping up with its regular maintenance can be expensive. If you are looking forward to renovating your home but falling short of money to pay for the project, applying for a loan for home renovation makes sense. Whether you are planning for an urgent repair or just want to add a few personal touches to make it safe and comfortable, you no longer need to whip out all your savings.

Instead, you can take a home renovation loan of up to ₹4.8 lakhs from Home Credit with instant approval and finance your home improvement project the way you want.

Are you unsure if taking a personal loan for home renovation is the best option for you? We will talk about why taking this route is a good idea. But first, let us earn what a home renovation loan entails.

What is a Home Renovation Loan?

A home renovation loan is an unsecured loan that you can take to renovate, upgrade, improve, or expand your house. Whether you are considering a bathroom or kitchen renovation or just adding some furnishings to your home, you can fund it with a personal loan for home renovation.

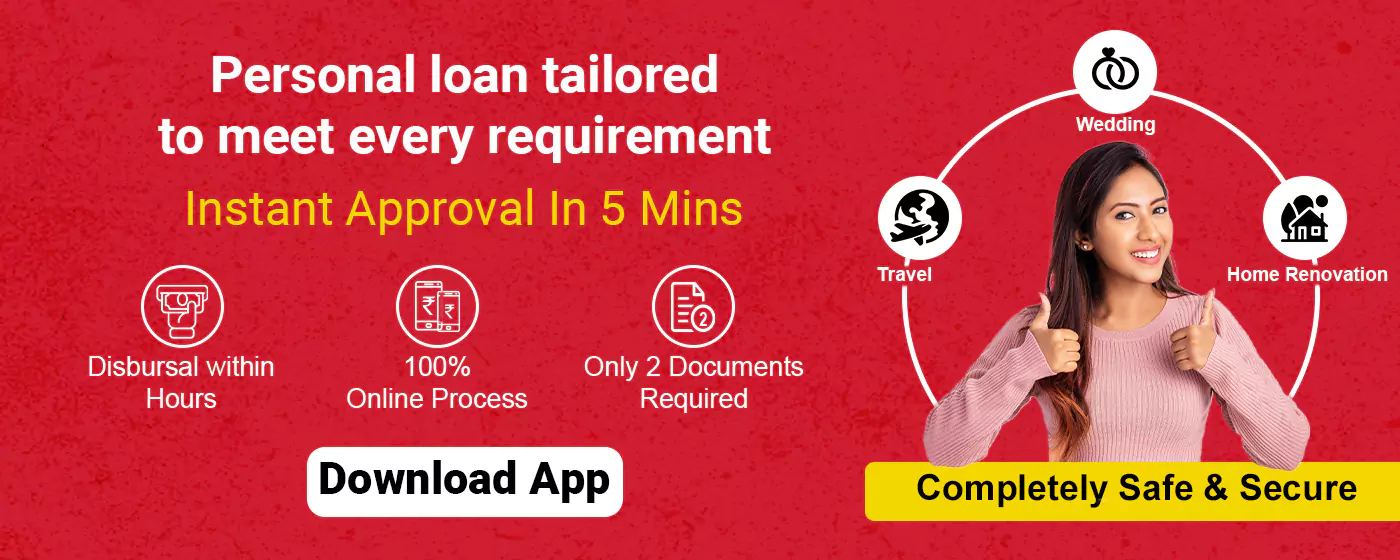

With Home Credit, you can apply for a home improvement loan of up to ₹4.8 lakhs, which you can repay with a flexible repayment tenure ranging from 9-51 months for existing home credit customers. The application and approval procedures are quick & hassle-free, and you can get instant approval on a loan amount of up to ₹4.8 lakhs with just 2 documents!

Now that we know what a home renovation loan is, let’s talk about the benefits of applying for a personal loan for home renovation:

Benefits Of Taking a Personal Loan for Home Renovation

The following are some benefits of taking a personal loan for home renovation:

- Depending on your requirements, the home improvement loan can be approved instantly, and your loan amount can be credited to you within a few hours.

- You can opt for a loan amount of up to ₹4.8 lakhs right from the comfort of your own home.

- You can apply for a home renovation loan with just 2 documents – your identity and address proof. Just download our app, share the required details, get your documents verified online, and choose your loan tenure as per your repayment capacity.

- You don’t need to provide any collateral or security to avail yourself of a personal loan for home renovation from Home Credit.

- Once your loan has been approved and you have received your loan amount, you can use it to cover any home improvement expenses you desire, whether you want to buy supplies, pay for labor, or hire a professional.

- You can finance your home renovation using your loan amount without any worries about its repayment. Home Credit offers a flexible repayment tenure ranging from 9-51 months for existing home credit customers. That means you have sufficient time to repay the loan amount in easy EMIs over time.

What Are the Eligibility Requirements for A Home Renovation Loan?

The eligibility criteria to avail yourself of a personal loan for home renovation is as follows:

- Be an Indian citizen aged between 18 and 60 years.

- Have valid ID proof and current address proof.

- Be employed, self-employed, or a pensioner.

- Maintain an active bank account.

- Ensure a minimum 90-day interval between two Home Credit loan applications.

- Demonstrate a monthly household income exceeding ₹25,000. “Household” refers to an individual family unit comprising a husband, wife, and their unmarried children.

- Need to be an existing customer of Home Credit (should have availed Ujjwal EMI Card/ Consumer Durable Loans/ Personal Loan/ Flexible Personal Loan in the past).

Documents Required to Apply for a Home Renovation Loan

To ensure that your home renovation loan application is processed efficiently, we only need a few documents:

- Proof of Identity: PAN Card (Mandatory)

- Address Proof:Aadhar Card/ Voter ID/Passport/ Driving License

How To Apply for a Home Renovation Loan with Home Credit?

To get a personal loan for home renovation of up to ₹4.8 Lakhs, just follow these three simple steps below:

- Enter your phone number and follow the next steps to check your eligibility.

- Enjoy instant online approval on home renovation loan of up to ₹4.8 Lakhs.

- Get the loan amount disbursed within hours of signing the agreement.

Home Credit offers a home renovation loan of up to ₹4.8 lakhs with instant approval, minimum documentation, and quick disbursal. So, what are you waiting for? Take advantage of our effortless application process and make your home a haven with home improvement as per your wishes.

Related Topics

- Borrowing

Mini Cash Loan- Quick Finance for Your Needs

With the growing digital economy, Fintech companies in India are making lending extremely easy for both the lenders and the borrowers.

- Borrowing

Can you get immediate loans in India?

With the level of digitalization is taking the lending scene one notch higher!

- Borrowing

Can you get Home Renovation Loans for a Mortgaged Property?

As we already understand, a home renovation loan is considered to make beauty changes to your existing property.

- Borrowing

Where to get a quick and easy instant loan online?

Easy and fast instant personal loans are important to fulfill your urgent financial requirements.

- Borrowing

Smartest Ways to Finance a New Business Set up

Every new business setup requires funds to embark on a journey of hard work, financial backup, solid product ideas, adequate stock, and a team of competent professionals.

- Borrowing

Equipment Loans for Business Expansion

Every business when gets started needs an initial push, this is similar to a solid business expansion.

- Borrowing

Can I Get A Personal Loan Online Without Branch Visit?

In today’s fast-paced world, convenience and accessibility have become paramount, and the financial industry is no exception.

- Borrowing

Want to Manage Big Spends? Opt for Instant Personal Loans!

In today’s fast-paced world, financial needs can arise unexpectedly, and sometimes our savings may not be enough to cover significant expenses.

- Borrowing

Advantages of Borrowing Personal Loans from a Loan App

In today’s fast-paced world, financial needs can arise unexpectedly, and having access to quick and easy lending options is essential.

- Borrowing

How to Fund a Last-Minute Vacation Without Credit Cards?

The sun is shining, the days are longer, and that unmistakable summer vibe is in the air.

- Borrowing

Looking for a Small Business Loan? Here’s How You Can Get It!

Are you looking for a small business loan? You’ve likely heard of Home Credit and are now ready to take that big step of applying for it.

- Borrowing

How Much Personal Loan Can I Avail with a 25000 Salary?

In today’s fast-paced world, personal loans have become a popular choice for meeting various financial needs.

- Borrowing

5 Instances When You May Need Personal Loans For Your Business

As a small business owner, you are no stranger to the constant need for financial resources to fuel growth and navigate through unexpected challenges.

- Borrowing

5 Tips to get an Easy Medical Loan in Hyderabad

How do you imagine a natural emergency to look like when it falls upon you? This could call for adequate financial security to cover for urgent requirements even in a city like Hyderabad.

- Borrowing

5 Common Hurdles of Individuals when Taking Loans

Applying for a loan is an easy ‘to do’. But, how many times does that application actually gets approved? Not always.

- Borrowing

3 Ways to Get Fast Approval on Your Next Cash Loan

When you find yourself in need of a quick cash loan, then waiting for approval can be frustrating.

- Borrowing

“Instant” cash loan safeguarding from contingent financial crisis

Belonging to an Indian middle-class family all through my life, I have been very careful about managing my expenses in proportion of my earnings.