Instant Personal Loan In 3 Easy Steps

Traditionally, extensive documentation, manual processes, multiple bank visits, endless paperwork, and a long wait for disbursal were a part of availing a personal loan. These lengthy application processes not only made availing a personal loan a mind-numbing affair, but also encouraged people to opt out of the process mid-way.

However, due to technology disruption, financial services are getting more advanced and quicker these days. Availing an instant loan online is the new normal. An Instant personal loan offers a completely digital process and requires minimum documentation.

At Home Credit, we provide a seamless loan journey from application to disbursal to meet our customers’ expectations. With a simple and speedy application process, we offer instant approval along with quick disbursal of funds with just 2 documents. Sounds like a dream, right? But what’s more?

Advantages Of Applying For An Instant Personal Loan With Home Credit

Applying for an instant loan using our personal loan app is quicker and easier as it can save time and exhaustion for the borrowers from running anywhere. You can just apply for an instant personal loan, get approval, and receive the loan amount of up to ₹5 lakhs right from the comfort of your home. Listed below are a few benefits of applying for an instant loan online with Home Credit.

- High Loan Amount Range: Home Credit offers a personal loan amount ranging from ₹10000 to ₹5 lakhs for existing customers to fund their expenses.

- Flexible Repayment Options:You can easily repay the loan amount in flexible EMI’s as per your convenience with a repayment tenure ranging from 9-51 months for existing home credit customers.

- Low EMI Amount:With Home Credit, you can avail yourself of a personal loan of up to ₹5 lakhs with easy EMI’s.

- No Collateral Required:You do not need to provide any collateral or any security to get a personal loan.

- Get Instant Loans with Just 2 Documents: To apply for an instant personal loan, you just need 2 documents – Your identity and residence proof.

- Simple Application Process: Applying for a personal loan with Home Credit is quick, easy, and seamless with minimal documentation and instant approvals.

- Digital First Process: Apply for an instant loan online with Home Credit and skip the long waits with a completely digital application process.

- No Hidden Charges: At Home Credit, transparent and secure processes are at the core of what we do, so everything you pay is what you know!

With over 10 million+ satisfied customers, Home credit aims to make personal loans affordable and accessible for all.

3 Stages Of An Instant Personal Loan From Home Credit

We have a 3-step personal loan application process. Listed below are the stages and essential information about our loan application process:

1. Check Your Eligibility

It is imperative that you check the details below to fulfill the eligibility criteria to apply for an instant personal loan. The eligibility criteria to avail yourself of a quick personal loan from Home Credit is as follows:

- Be an Indian citizen aged between 18 and 60 years.

- Have valid ID proof and current address proof.

- Be employed, self-employed, or a pensioner.

- Maintain an active bank account.

- Ensure a minimum 90-day interval between two Home Credit loan applications.

- Demonstrate a monthly household income exceeding ₹25,000. “Household” refers to an individual family unit comprising a husband, wife, and their unmarried children.

- Need to be an existing customer of Home Credit (should have availed Ujjwal EMI Card/ Consumer Durable Loans/ Personal Loan/ Flexible Personal Loan in the past).

2. Keep Your Documents Ready

To ensure that your instant personal loan application is processed efficiently, we only need 2 documents:

- Proof of Identity: PAN Card (Mandatory)

- Address Proof:Aadhar Card/ Voter ID/Passport/ Driving License

Make sure to keep these documents handy when applying for an online personal loan with Home Credit.

3. Get Instant Approval On Up To ₹5 Lakhs

To get a personal loan up to ₹5 Lakhs, just follow these simple steps below and get instant approval:

- Enter your phone number and follow the next steps to check your eligibility.

- Get instant online approval on personal loan of up to ₹5 Lakhs.

- Get the loan amount disbursed within hours of signing the agreement.

So, what are you waiting for? Apply for a Home Credit personal loan now!

Related Topics

- Financial Literacy

Can’t find a guarantor for a loan? Here’s what your option

If we talk about a classic example, we should be able to go to the bank, submit our paperwork, and receive approval from them almost immediately – without any other detours.

- Financial Literacy

Aadhaar Virtual ID – How Safe is it?

You will now be using your Aadhaar virtual ID or VID similarly as you utilize your Aadhaar card details when it comes to banking operations, telecom organizations and so on.

- Financial Literacy

Credit Score – Facts & Myths

A credit score is a significant number for the lenders and borrowers, both. Along with the credit score, the credit report helps substantially o estimate the borrowing capacity of the prospects now and later.

- Financial Literacy

Reasons Why Instant Loans Help You Overcome Emergency Situations

Life is unpredictable; you never know what it may have in store for you.

- Financial Literacy

Why Are There Different Types Of Credit Scores?

The borrower’s credit history and trustworthiness become important criteria that help lenders decide whether to provide him or her with a loan or not when it comes to obtaining a collateral-free loan, whether it be a small business loan or a personal loan.

- Financial Literacy

Aadhaar Virtual ID And its Benefits

Considering the protection of the individual information including the statistic and biometric data specified on the Aadhaar card, UIDAI has of late chosen to think of one of a kind element, named as Virtual Aadhaar ID.

- Financial Literacy

Virtual ID in the Real World

Have you heard about Virtual ID? UIDAI introduced Virtual IDs after facing concerns over security of users’ data.

- Financial Literacy

Tired of Unwanted Calls? Reclaim Your Peace with TRAI DND!

In today’s digital age, our phones are irreplaceable, but they also bring tons of unwanted calls and messages.

- Financial Literacy

RBI Ki Fraud Ke Khilaf Ladai Mein Shaamil Hon: Bareilly Aur Pilibhit Mein Consumer Jagrukta Karyakram

Bharatiya upbhokta ke roop mein, aapke paas fraaud ke khilaf ladne ke bohot se adhikar hote hain aur Reserve Bank of India unhe surakshit rakhne ke liye ek RBI Consumer Awareness Program shuru kar raha hai. Kanpur ke RBI Ombudsman Office aapko jagrukta ke madhyam se shakti pradaan karna chahta hai.

- Financial Literacy

How to Build Your Credit Score from Scratch?

Your credit score is a critical aspect of your financial health.

- Financial Literacy

How to Get a Personal Loan for Self-Employed Individuals?

In today’s dynamic economy, more and more people are opting for self-employment as it offers flexibility and the opportunity to pursue one’s passion.

- Financial Literacy

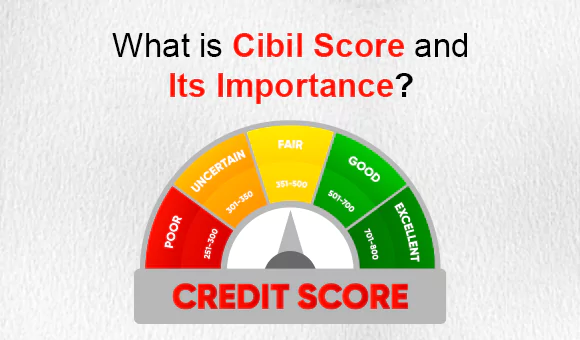

What is Cibil Score and Its Importance?

A CIBIL Credit report consists of all the particulars related to your borrowing history and the discipline of its repayment.

- Financial Literacy

All You Need to Know About Credit Score

Have you ever been wondering about what a credit score is? What’s all the big fuss about it? Understanding them will benefit you at some time in your life.

- Financial Literacy

Useful Tips for Personal Loan EMI Management

In today’s fast-paced world, personal loans have become an essential financial tool to meet various needs and aspirations.

- Financial Literacy

Does the Purpose of Personal Loan Affects Loan Approval?

When it comes to personal finance, taking a personal loan is often seen as a versatile solution to meet various financial needs.

- Financial Literacy

Pros and Cons of Long-Term Personal Loans

Personal loans are one of the most popular forms of borrowing, allowing individuals to obtain funds for various purposes

- Financial Literacy

Personal Loans Vs. Mortgage: Choosing The Right Path To Financial Freedom

When it comes to achieving financial freedom, making the right choices about borrowing money can be a pivotal decision.

- Financial Literacy

Understanding Personal Loan Interest Rates and Calculations

Personal loans can be a great way to manage big expenses or emergencies, but do you know how their interest is calculated? It’s not as tricky as it seems!

- Financial Literacy

5 Financial Lessons to Master by Age 30

Many lessons learned can be financially draining, take them all seriously to take critical financial decisions that may be skipped otherwise.

- Financial Literacy

3 Smart things to know before Co-Signing a Loan

When an instant loan is applied for both the co-signer and co-borrower are equally responsible for the loan taken.

- Financial Literacy

10 Things that Lower Your Credit Score

When it comes to your credit score, there are some things that can make it go down.