How To Choose The Right Credit Card?

In a world where financial transactions are increasingly digitized, credit cards have become an indispensable tool for managing our day-to-day expenses. However, with a myriad of options available in the market, choosing the right credit card can be a daunting task.

Whether you’re a seasoned cardholder or a first-time applicant, understanding your needs and evaluating the features of different credit cards is crucial. This blog aims to guide you through the process of selecting the right credit card that aligns with your lifestyle and financial goals.

Understand Your Spending Habits:

Before diving into the sea of credit card options, take a moment to reflect on your spending habits. Are you a frequent traveler, a shopaholic, or someone who prioritizes cashback? Identifying your primary spending categories will help you narrow down the types of credit cards that offer the most significant benefits for your lifestyle.

Interest Rates and Fees:

The annual percentage rate (APR) is a critical factor to consider when choosing a credit card. This rate determines the interest you’ll pay on outstanding balances. If you plan to carry a balance, opt for a card with a lower APR to minimize interest charges. Additionally, be aware of other fees such as annual fees, late payment fees, and foreign transaction fees. Choose a card with fees that align with your financial habits.

Rewards and Perks:

Credit card rewards can come in various forms, including cashback, travel miles, points, or discounts. Consider your priorities and select a card that offers rewards in areas you frequently spend money. Some credit cards also come with perks such as travel insurance, airport lounge access, and extended warranty protection. Assess these additional benefits to determine the overall value of the card.

Credit Limit:

Your credit limit is the maximum amount you can borrow on your credit card. Choose a card with a credit limit that accommodates your spending needs without encouraging excessive debt. If you have a good credit history, you may qualify for higher credit limits, but be cautious not to overextend yourself.

Credit Score Requirements:

Different credit cards have varying credit score requirements. Check your credit score and choose a card that aligns with your current standing. If you have a limited credit history, consider starter or secured credit cards designed for individuals building or rebuilding credit.

Customer Service and Security:

Evaluate the customer service reputation of the credit card issuer. Efficient customer support can be crucial in resolving issues or addressing concerns. Additionally, prioritize cards that offer robust security features, such as fraud protection and identity theft alerts, to safeguard your financial information.

Conclusion

Choosing the right credit card is a personal decision that requires careful consideration of your spending habits, financial goals, and lifestyle. By understanding the key factors outlined in this guide, you can navigate the credit card landscape with confidence and select a card that improves your financial well-being.

Related Topics

- Financial Products and Services

A Quick Health and Fitness Guide for New Entrepreneurs

Health is that element of life, which if not taken care of, devastates the other elements.

- Financial Products and Services

Top Advantages of an Online Loan Market

Financial technology and internet connectivity together have facilitated the online loan marketplaces.

- Financial Products and Services

Top 3 Government Start-up Schemes in India

As per some interesting reports, the number of start-ups has almost multiplied 7X times from 7000 in 2008 to 50,000 in 2018.

- Financial Products and Services

The Fast-Paced Growth of Fintech: This how it is

Now that technology is reaching every small segment in the business economy, how can finance be left behind?

- Financial Products and Services

How to Apply for an Instant Personal Loan in Emergency?

From a larger perspective, an emergency personal is the future ahead.

- Financial Products and Services

Is Home Credit Personal Wedding Loan a Good Way to Cover Wedding Costs?

Personal loans by Home Credit are quite satisfactory for weddings.

- Financial Products and Services

How to observe ‘Work from Home’ Scams

Even before COVID 19 pandemic knocked our doors, work from home was trending as the new normal.

- Financial Products and Services

Online Loans are changing the Banking Landscapes

Online loan applications are now tried and tested procedures for most banks and financial institutions.

- Financial Products and Services

Top 5 advantages of Two-Wheeler Loans in India

Today’s time is extremely fast moving.

- Financial Products and Services

Surprise Your Family with a New Car with Home Credit Personal Loan

A car loan is opted for when the requirement for a car purchase is huge.

- Financial Products and Services

How the Aarogya Setu App became Compulsory for Travel?

Aarogya Setu is a brilliant app as an initiative to connect essential health services to Indian citizens to keep their fight alive against Covid-19 pandemic.

- Financial Products and Services

Can You Have Too Many Credit Cards?

Your credit score is an essential component of your overall financial health, so it is important to make sure you do not do anything that could damage it.

- Financial Products and Services

Technologies Used for Faster loan Sanctioning and Disbursal

Applying for a loan and getting one is quite easy compared to how it used to be.

- Financial Products and Services

Managing Credit Risk Effectively with Six Main Elements

Credit risk management is an essential part of any financial institution, as it helps to ensure that they can meet its financial obligations and maintain a healthy cash flow.

- Financial Products and Services

How to Become a Good Income Taxpayer?

You have paid all your taxes. You have filled your Income Tax returns diligently.

- Financial Products and Services

Home Credit – Your One Stop Solution to Online Loans

There is a plethora of loans out in the market to cater to specific needs.

- Financial Products and Services

Everything You Need to Know About Bad Credit Score

When we are talking about credit – the level of trust business organizations has that you will repay the money you have borrowed – you can either have a good credit score or a bad credit score.

- Financial Products and Services

The Basic Challenges faced by the Fintech Industry

FINTECH is a combination of two words: financial technology. In simple words, Fintech is any technology and related innovations used in the various financial institutions.

- Financial Products and Services

How to apply for a Small Loan in India?

Getting a loan sanctioned for small businesses is extremely significant.

- Financial Products and Services

Ways to Manage Finances When You Have Dependents?

When you have dependents (children & parents) on the top of your head, earning income to save and invest becomes a derivative.

- Financial Products and Services

What all Should you know About Small Business loans?

Small businesses are believed to be the powerhouse of the Indian economy.

- Financial Products and Services

Credit Card or Debit Card – Which Is Better For Investing

The mantra for a good financial health is to save money from income and then go about your monthly expenditures.

- Financial Products and Services

Can we Apply for Credit Card and Loan at the Same time?

If you are only concerned whether you can apply for a credit card and loan at the same time, then the answer is yes, you can!

- Financial Products and Services

Free Credit Report: Is It Really Free?

Nowadays, in and around the financial environment, every lender looks at your credit score before considering your borrower profile.

- Financial Products and Services

5 Reasons to Get a Small Business Loan

Whenever you’re considering a business loan, it’s quite common to hear different opinions on its application & use.

- Financial Products and Services

Closing your Credit Card without hurting your Credit Score

Are you thinking to cancel your credit card? Before you think of cancelling your credit card, think twice!

- Financial Products and Services

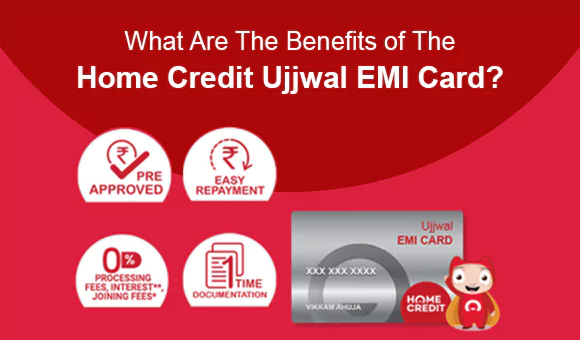

What Are The Benefits of The Home Credit Ujjwal EMI Card?

We all have goals in life, whether it’s to buy the best smartphone to pursue our passion for photography or to buy the latest refrigerator for our mothers to proudly display in their kitchens.

- Financial Products and Services

8 Reasons To Apply Personal Loan From Home Credit

From time to time, we always have crucial decisions to make, and chances are that it will cost money!

- Financial Products and Services

Multiple Credit Cards: Good or Bad?

Having a credit card is a common financial tool that offers convenience and purchasing power. But what about having multiple credit cards?

- Financial Products and Services

How To Make the Most of Your Credit Card?

Today, we’re going to talk about credit cards, and how to make the most out of them.

- Financial Products and Services

Ujjwal EMI Card vs Credit Card: How To Shop on EMI?

Nowadays, shopping on EMI is the new trend. On EMI, you can buy anything from electronics to home appliances.

- Financial Products and Services

Easy Financial Planning with a Personal Loan EMI Calculator

Managing finances is an integral part of our lives, and at times, unexpected expenses or opportunities may arise that require additional funds.

- Financial Products and Services

5 Things 'To Do' Before a Closing Credit Card

Don’t even think about canceling that card before you do these five things.

- Financial Products and Services

4 Tips to check before withdrawing Cash from Credit Card

Getting your first credit card can be exhilarating as it indicates you have finally arrived.

- Financial Products and Services

5 Best Personal Finance Tools

A new year begins with the ray of hope for greater profitability & that your investments will only move positively.

- Financial Products and Services

3 Top Credit Cards Available in India

Are you looking for a credit card to shop for your favorite items? Typically, the younger generation, office class likes to get the best cards for shopping & lifestyle in India.