How smart is it to borrow from your friends and family!

"Care for your relationships like you care for your money." – Anonymous

Growing up, Pooja and her elder sister Nisha were very close. When Nisha started working, Pooja was in college and Nisha would send her some extra money. Over a period of time, Pooja got into a habit of borrowing money from her sister for the smallest to the biggest things. The last time, Pooja asked Nisha for Rs 50,000 to buy a new smartphone, Nisha offered her Rs 30,000 which was not enough for Pooja and Nisha was already too stretched but still lent her sister the money. Both felt cheated. After all, Pooja always returned the money and couldn’t understand why her sister refused to give her the money. Nisha, on the other hand, felt that she couldn’t say no even though she herself was going through a cash crunch. This resulted in the souring of relationships with the sisters, not talking to each other for almost one year.

Unfortunately, this is all too common. We somewhere take our friends and family for granted and think they’ll always be there to help us when we need help, whether emotional or financial. A lot of times, this comes at the cost of our long-cherished relationships.

Here is what you need to think about before you borrow from or lend to your close friends or family.

Rule 1: Think about the other person

"Instead of loving people and using money, people often love money and use people." – Wayne Trotam

Instead of thinking about how much money you want to fulfil your need, think about how much money can your loved one afford to lend to you. This is very important because your loved ones might lend you more than they can afford in an effort to help because they care about you. This might end up straining them and then straining your relationship.

Also, unlike a bank, when borrowing from a friend or relative, do not negotiate for an amount they cannot afford. So, if you have a requirement of Rs. 5000 but your lender can only give you Rs. 2000, accept the favour graciously. This short-term adjustment will help you preserve your relationships in the long run.

Rule 2: Have a frank conversation

"Friendship is in trouble when comfortable silences become uncomfortable."

This rule applies more to the lender than to the borrower. Money is never a comfortable conversation to have with friends or family. But in case of lending money, you must have a frank conversation and put forth all your expectations. Do understand that your friend or relative will not be able to read your mind.

For example, in case you are expecting interest to be paid to you, you must let your friend or colleague know in advance before lending the money. You should also state the number and see if it works for both the parties. Similarly, if you are expecting payments to be made by a certain time, have a conversation.

As a borrower, it is your responsibility to not get lazy about your payments because while your credit score is not at risk, a relationship might be hanging in the balance, which is more important.

Also, both the parties should ask for clarifications, if any. For example, as a lender, if you feel that you might not be paid back or that money is not being used wisely, it is totally okay not to lend the money.

Rule 3: Consider other options first

"Never let desperation force you to make choices you ordinarily wouldn’t make."

Friends and family will always stand by you in times of need. But that shouldn’t be the reason to go to them every time you hit a rough patch or need something.

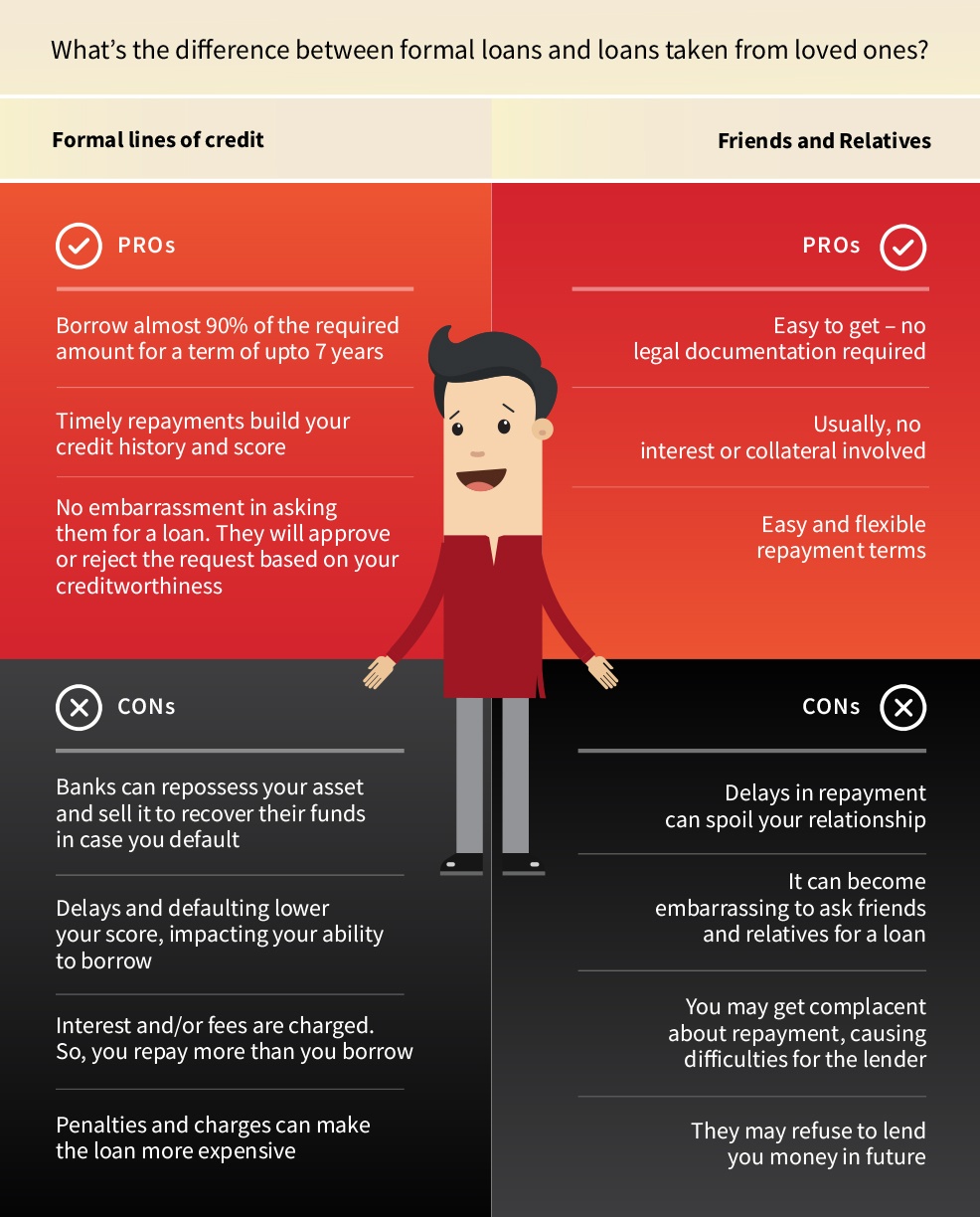

First, help yourself - save for that desire/need, try budgeting, cut unnecessary expenses, take a formal loan you can repay in instalments if you have a good credit score, etc. If that doesn’t work and borrowing from a friend or family is the best option, only borrow if you know you can pay them back.

Go to Do you know the right types of loans for your needs? to know about suitable credit options for specific needs.

Rule 4: Seal the deal

Even if you borrow from your best friend, formalise the deal. Writing down reinforces your responsibility and creates trust. It also pushes you to manage your money wisely and set this loan repayment as one of the priorities.

Rule 5: Maintain your relationships

"Some people are so poor, all they have is money."

Try to keep the relationship as it is, despite the borrowings. As a borrower, you should neither try to over-compensate because of a sense of compulsion from the borrowing, nor should you let a relationship become completely about financial exchanges. Similarly, as a lender, you shouldn’t feel that you have unlimited access to the borrower’s financial condition, or you shouldn’t make snide comments about the borrower either in private or in public.

Borrowing from loved ones can be tricky, and it should not be your first option. But if you have to, honour your promises and don't take relationships for granted.

Related Topics

- Credit history is your financial collateral

How To Improve CIBIL Score In 30 Days?

Your CIBIL score is an important factor in finding out your creditworthiness and can affect your ability to obtain loans, credit cards, and other financial products. A low CIBIL score can lead to higher interest rates, which can be a burden on your finances.

- Credit history is your financial collateral

Credit bureaus and the role they play

Have you ever wondered what exactly a credit bureau does? This article will help you understand the role that credit bureaus play in an economy and the ways in which they can help you as a borrower.

- Credit history is your financial collateral

Where to get your credit report, How to read it!

A lot of people find it difficult to understand their credit reports. This piece tell you how to read your credit report section by section and helps you understand which portions mean what, like the first portion contains personal details,the second portion reflects one;s employment details like income, the next portion has details about the loans acquired and their history, etc.