What is a budget? Why is it so important!

Do you often wonder where does your monthly salary go when there are still bills to be paid? Do you lose sleep at night wondering, if you suddenly lost your job how you will meet your expenses for the next few months? Are your children upset with you because the vacation that you were planning, had to be postponed as you are short of funds? Did your parent have a medical emergency and you ended up borrowing money to meet the expense? If the answer to the above is yes, you are not alone. Almost 70% of the population struggles to manage their expenses within their earnings. If you have been in one (or more) of these situations at some point, the one-stop solution to your problems is budgeting.

What is budgeting?

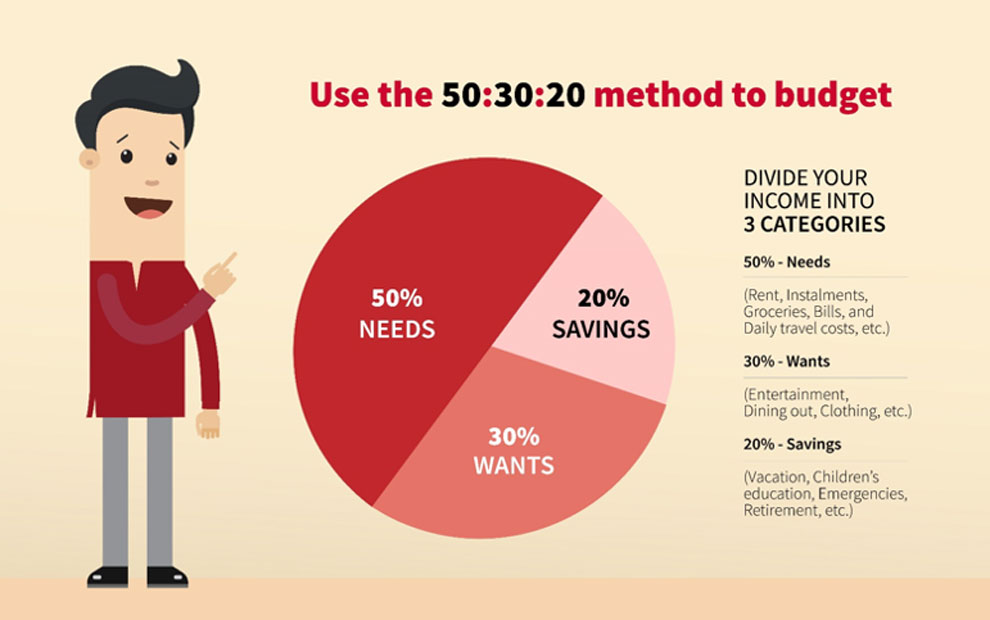

"A budget is telling your money where to go, instead of wondering where it went." – Dave Ramsay Budgeting is the process of creating a spending plan for your money. By creating this spending plan, you can determine in advance whether you will have enough money to do the things you need to do or would like to do. If you see that you don't have enough money to do everything you would like to do, then you can use budgeting to prioritise your expenses and allocate your money to the things that are most important to you.

Why is budgeting important?

1. Gives you a 360° view of your financial standing

Having a budget helps you get a clear idea of how much money you have every month, and how much you can afford to spend while still saving for emergencies and financial goals. Understanding where you are spending money can also give you clarity on how to divide it amongst your needs and wants.

2. Allows you to align your monthly expenses

The mark of a great budget is paying all that you owe and still having some leftover amount at the end of every month. Adjust how you budget your money every month to suit your circumstances. For example, if you have EMIs, pay those before spending on other things, so that you never miss out on a payment ever again.

3. Enables you to fulfil your financial goals

A budget helps you to set financial goals and save up for them - be it saving up the down payment for a home loan, for children’s education or for a business that you plan to start. A budget can help you redirect your money from unnecessary spending to important goals.

4. Helps you save for a rainy day

Budgeting can help you safeguard your finances against unexpected events if you set aside a small amount in your monthly budget to build an emergency fund. Just like an ant saves food every day to prepare for the winter, it's important that you have an emergency fund for any unforeseen circumstances, which is different from saving up for a long-term goal. Set aside a small percentage of your income until you have enough money to cover at least three to six months’ worth of expenses.

5. Curbs excessive borrowing

With a budget, you can manage your expenses within your income and stop unnecessary borrowing for every big or small expense. Impulsively spending on unnecessary things reduces your spending power every month as more and more of your money is directed towards paying interest costs or for things that won’t have any value in the long run. With a budget, you can even plan for those months when you have additional expenses due to festivals, parties, gifts for weddings, or a destination vacation etc.

6. Reduces money-related stress

"A big part of financial freedom is having your heart and mind free from worry about the what-ifs of life." - Suze Orman

Having a budget can help manage your money wisely, thus relieving you of stress and sleepless nights. This means that you will be able to afford that extra takeout meal without wondering if you’re cutting into your dream home! While crunching numbers may not be your idea of an ideal Sunday, taking time out to budget every once in a while allows you to spend money with confidence. Thus, budgeting becomes the foundation of your pursuit of financial happiness.

Pro tip: To reduce the time and effort spent on managing your money on the weekends, use a budgeting app to quickly record all your expenses every single day.

A budget is much easier to make than you may think. The important thing is to make it work for you by readjusting it according to your changing priorities and lifestyles. This way, you can have the money to spend on things that matter to you and make you happy.

If you’re planning on creating your own budget, here’s how to create a budget that suits you.

Related Topics

- Managing Debts

Making the Right Financial Decisions Through Financial Literacy

In a world driven by constant change and economic uncertainties, the ability to make informed financial decisions is more crucial than ever.

- Managing Debts

How To Keep Yourself Safe From Online KYC Scams?

In an era dominated by digital interactions, the convenience of online services comes with an inherent risk

- Managing Debts

Why 77% of Working Professionals Rely on Personal Loans?

In today's fast-paced world, managing finances can be a daunting task for working professionals.

- Managing Debts

How to Choose Your Ideal Repayment Tenure for Personal Loans?

Personal loans have become an indispensable financial tool for many individuals, offering a quick and convenient way to address various financial needs.

- Managing Debts

Top 10 Ways to Identify Personal Loan Scams Online

In a world driven by digital advancements, online personal loans have become increasingly popular in India.

- Managing Debts

What is Repo Rate? How Does it Affect the Economy?

Have you ever heard the term "repo rate" and wondered what it's all about? Well, you're not alone.

- Managing Debts

What is Debt to Income Ratio and How is it Calculated?

Managing your finances wisely is essential for a secure financial future. One crucial aspect of financial health that often gets overlooked is the Debt-to-Income Ratio (DTI).

- Managing Debts

Things to Tell Your Child When They Apply for Their First Personal Loan

As your child ventures into adulthood, they will face various financial milestones, one of which may be applying for their first personal loan.

- Managing Debts

How Can a Personal Loan Be Used as an Investment?

In today's fast-paced world, financial goals and dreams are many. Whether it's pursuing higher education, starting a small business, or renovating your home, we all have aspirations that require financial support.

- Managing Debts

5 Smart Tips For Easy Personal Loan Management

In today's world, personal loans have become an important financial tool to help individuals meet their financial goals. Be it organizing a wedding, buying a car or house, or even consolidating debt, personal loans can provide much-needed financial help.

- Managing Debts

Did you know credit scores affect your job prospects besides future borrowing!

You may have heard about credit scores if you have applied for a loan. But most of you may not know about its impact on things apart from your borrowings. This piece can help you understand other such ways in which your credit score may affect you.

- Managing Debts

Things you should always check while borrowing money

Interest rate is what a loan company or bank charges for the loan amount they grant you. It is an important factor that determines the total cost of the loan.

- Managing Debts

Could your decision to take another loan make you regret later!

Have you ever made an impulsive purchase and regretted later? Or fell into the trap of a promotional offer? This article tells you the important questions that you must ask before deciding to borrow money for anything.

- Managing Debts

Do you have everything you need to apply for a loan!

Are you planning to take a loan soon? But are you fully prepared to take the loan? Here’s a checklist you must read to make sure your loan application is processed and approved easily.

- Managing Debts

Heard of paying yourself first? – Here is why it is important

Paying yourself first ensures you always save money. Read on to understand more about what it is and how it can help you.