Top Suggestions

New Delhi, November 03, 2020: The ongoing pandemic has had a drastic impact on the economy and people across the strata of the society. With job losses and pay cuts across industries, the lower middle-income group has been affected severely. The pandemic has led to a shift in perspective towards loans and borrowing preferences.

Home Credit India, a local arm of the international consumer finance provider with operations spanning over Europe and Asia, conducted a research across 7 cities, to understand the borrowing patterns of people during the COVID lockdown.

| Cities covered under the survey: |

|---|

|

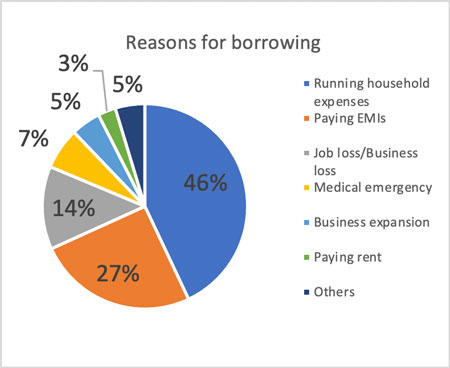

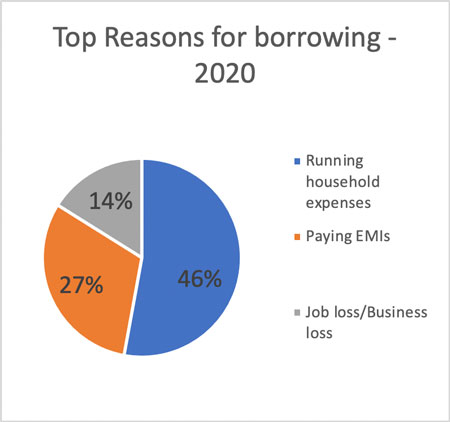

The research revealed that 46% respondents borrowed money primarily to run their households. The impact of the pay cuts/delays was the next big reason why most borrowers resorted to borrowing, 27% of respondents cited repayment of their monthly instalments from the earlier loan as the second biggest reason behind borrowing. 14% of the respondents borrowed as they suffered job losses.

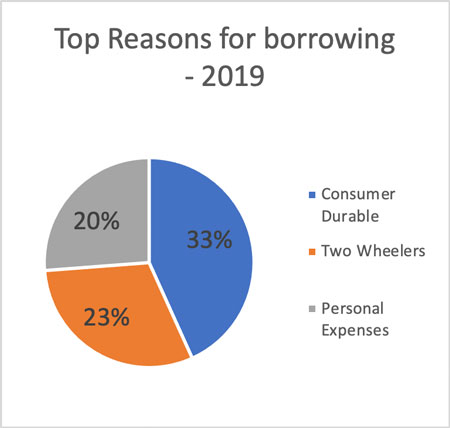

A similar study was conducted by Home Credit India in August 2019. The study then revealed that among the primary reasons for borrowing money, fulfilling family’s needs topped with 46% of the respondents followed by the desire to upgrade their lifestyle which was at 33%. Lifestyle upgrades were quoted as an updated smartphone/TV/refrigerator or vehicle.

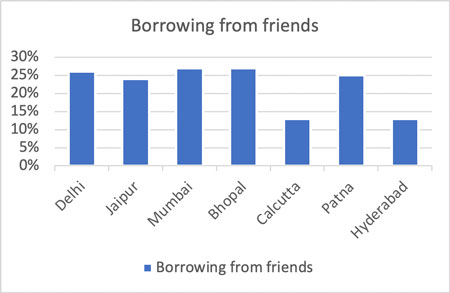

Another insight of the research reveals, unlike normal times, during COVID, people preferred to borrow money from their friends and families as it gave them the flexibility to return the money when the situation normalised/jobs and salaries were restored. The research also showed that 50% of the respondents admitted to returning the borrowed sum once the situation normalised/they returned to their jobs. 13% of the people said they will look at returning the sum after paying their loan amounts.

Speaking about the research, Mr. Marko Carevic, Chief Marketing and Customer Experience Officer said; “We undertake a research every year to understand our customers and their preferences better. The impact of the pandemic is still unfolding, and people have gone through an extremely difficult time. Our research on the borrowing patterns of India has revealed some interesting new trends which contrast with the trends of the pre-COVID times. The lockdown time has seen borrowing happening from family and friends due to the flexibility in returning the amount as the pandemic has set a lot of uncertainty in the lives of people. Incomes are scrunched making people borrow money to run their households.”

Borrowing from friends and family was seen highest in Mumbai and Bhopal at 27% each followed by Delhi at 26% and Patna at 25%. The research also revealed that the decision to borrow money from family and friends was led by the Male members of the households at 23%. The women interviewed in the research revealed a preference towards either not borrowing or borrowing from financial institutions as against family and friends.

Home Credit serves 11.3 million customers with plethora of hassle-free financing options which can be availed from a strong network of around 31,500 points-of-sale (PoS) presents across 350 cities. The company is committed to drive credit penetration and broaden financial inclusion through responsible lending in the country.

About Home Credit India:

Home Credit India Finance Pvt. Ltd. is a local arm of the international consumer finance provider with operations spanning over Europe and Asia and committed to drive financial inclusion in India. The company is committed to drive credit penetration and financial inclusion by offering wide financial solutions that are simple, transparent, and accessible to all. Home Credit India has an employee base of close to 14,000 and has been consistently expanding operations since its entry in 2012, with its operations spread over 350 cities across 22 States in India. The company has a strong network of over 31,500 points-of-sale (PoS) and is growing with a customer base of 11.3 million customers, driven by Pan-India expansion across major markets, a range of diversified and innovative products backed by superior customer experience.

For more information, visit www.homecredit.co.in

For more information, contact:

| Home Credit | First Partners |

|---|---|

| media@homecredit.co.in | Payal Yadava: payal.y@firstpartners.in |