8 Reasons To Apply Personal Loan From Home Credit

From time to time, we always have crucial decisions to make, and chances are that it will cost money! Whether it is a new home appliance, an automobile or a house renovation, or any other personal reason, one needs a substantial amount of money to achieve what we desire. In such circumstances, a personal loan fits right in!

This is because the money required is not too big an amount, but neither is it too little to just withdraw from our bank balance. Sometimes we are even cash crunched. Thus, a personal loan from Home Credit is an apt choice to apply for it!

Why Choose Home Credit Personal Loan?

Here are a few reasons why Home Credit instant personal loan can be your best bet in times of need:

1. Freedom To Use at Your Discretion

One of the biggest advantages of taking a personal loan from Home Credit is that we do not pose any restrictions on the usage of your loan amount. An instant loan up to ₹5 lakhs can be used for any purpose that you want. There are several types of quick personal loans offered by us, including:

- Travel loan

- Education loan

- Medical emergency loan

- Home renovation loan

- Small Business loan

- Self Employed loan

2. Easy Eligibility Criteria

The eligibility criteria to avail yourself of a quick personal loan from Home Credit is as follows:

- Be an Indian citizen aged between 18 and 60 years.

- Have valid ID proof and current address proof.

- Be employed, self-employed, or a pensioner.

- Maintain an active bank account.

- Ensure a minimum 90-day interval between two Home Credit loan applications.

- Demonstrate a monthly household income exceeding ₹25,000. “Household” refers to an individual family unit comprising a husband, wife, and their unmarried children.

- Need to be an existing customer of Home Credit (should have availed Ujjwal EMI Card/ Consumer Durable Loans/ Personal Loan/ Flexible Personal Loan in the past).

3. Customizable Repayment Options

One of the reasons why Home Credit personal loan proves to be the best option is because we offer customizable repayment tenure ranging from 9-51 months for existing home credit customers so that you can repay your loan at your convenience, without any hassles.

4. Instant Loan Approval with Quick Disbursal

Home Credit offers you instant approval on a personal loan up to ₹5 lakhs along with quick disbursal which makes us the ideal option for avoiding financial roadblocks.

5. Minimal Document Requirement

We only ask for 2 documents that are necessary to process your instant personal loan application.

- Proof of Identity: PAN Card (Mandatory)

- Address Proof:Aadhar Card/ Voter ID/Passport/ Driving License

6. No Collateral Needed

While applying for a quick personal loan with Home Credit, you don’t need to worry about collateral or putting any of your assets at risk. Just verify/upload the documents online and you are done!

7. Easy Online Loan Application Process

Getting a personal loan up to ₹5 lakhs is just three easy steps away from our personal loan app.

- Enter your phone number and follow the next steps to check your eligibility.

- Get instant approval on loan amount of up to ₹5 Lakhs.

- Enjoy quick & hassle-free fund disbursal within hours of signing the agreement.

8. No Hidden Charges

We make every effort to make our procedures as transparent as possible. Therefore, you won’t have to be concerned about any hidden charges!

Need instant funds? Apply for a personal loan right now and get instant approval on up to ₹5 lakhs with just 2 documents!

संबंधित विषय

- Financial Products and Services

Closing your Credit Card without hurting your Credit Score

Are you thinking to cancel your credit card? Before you think of cancelling your credit card, think twice!

- Financial Products and Services

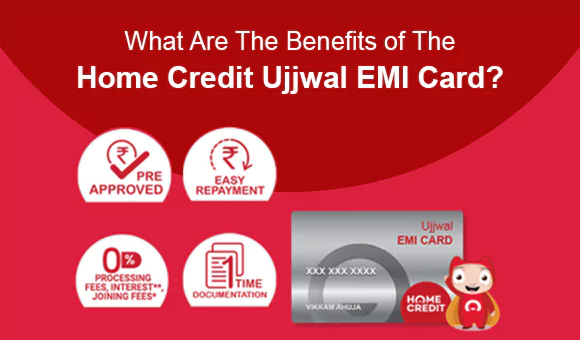

What Are The Benefits of The Home Credit Ujjwal EMI Card?

We all have goals in life, whether it’s to buy the best smartphone to pursue our passion for photography or to buy the latest refrigerator for our mothers to proudly display in their kitchens.

- Financial Products and Services

Multiple Credit Cards: Good or Bad?

Having a credit card is a common financial tool that offers convenience and purchasing power. But what about having multiple credit cards?

- Financial Products and Services

How To Make the Most of Your Credit Card?

Today, we’re going to talk about credit cards, and how to make the most out of them.

- Financial Products and Services

Ujjwal EMI Card vs Credit Card: How To Shop on EMI?

Nowadays, shopping on EMI is the new trend. On EMI, you can buy anything from electronics to home appliances.

- Financial Products and Services

Easy Financial Planning with a Personal Loan EMI Calculator

Managing finances is an integral part of our lives, and at times, unexpected expenses or opportunities may arise that require additional funds.

- Financial Products and Services

How To Choose The Right Credit Card?

In a world where financial transactions are increasingly digitized, credit cards have become an indispensable tool for managing our day-to-day expenses.

- Financial Products and Services

5 Things 'To Do' Before a Closing Credit Card

Don’t even think about canceling that card before you do these five things.

- Financial Products and Services

4 Tips to check before withdrawing Cash from Credit Card

Getting your first credit card can be exhilarating as it indicates you have finally arrived.

- Financial Products and Services

5 Best Personal Finance Tools of 2024

A new year begins with the ray of hope for greater profitability & that your investments will only move positively.

- Financial Products and Services

3 Top Credit Cards Available in India in 2024

Are you looking for a credit card to shop for your favorite items? Typically, the younger generation, office class likes to get the best cards for shopping & lifestyle in India.