Ujjwal EMI Card vs Credit Card: How To Shop on EMI?

Nowadays, shopping on EMI is the new trend. On EMI, you can buy anything from electronics to home appliances. Although the process of shopping with EMI cards and credit cards is very similar, there are some differences we should know about.

We have been using credit cards for a long time. They help us make purchases and pay back later in equal monthly instalments. Along the same lines, EMI cards are now available. They are a relatively new payment option. However, EMI Cards make the borrowing process easier and more convenient by including features such as ZERO processing fees*, great customized deals, and instant approval.

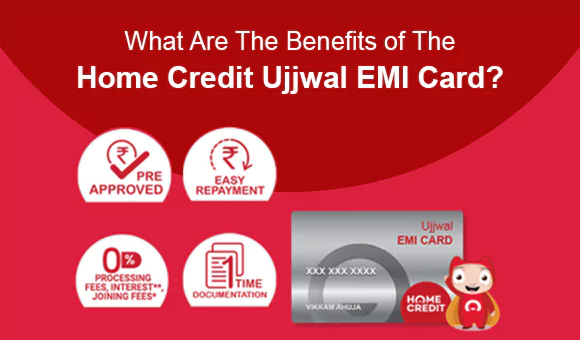

About Home Credit Ujjwal EMI Card

Home Credit Ujjwal EMI Card is one of the most popular, hassle-free, and convenient EMI cards. It serves as a payment option for EMI purchases of products ranging from mobile phones to washing machines and more. Our Ujjwal EMI Card has a pre-approved credit limit of up to Rs. 75000 and can be used for both online and offline purchases. The used credit limit can be repaid in easy EMIs over time.

You can shop on EMI on either of our 31000+ partner stores or any of our online partner stores in India. Apart from this, you can also enjoy the flexibility to choose your repayment tenure as per your convenience. Also, there are no foreclosure charges if you want to close the loan before the predefined tenure.

Ujjwal EMI Card vs Credit Cards: Which Is Better?

In the battle of Ujjwal EMI Card vs Credit Cards, let’s take a quick look at the benefits listed below to see how Ujjwal EMI Card stands out.

| Ujjwal EMI Card | Credit Cards | |

| Eligibility Criteria |

|

|

| Documents Required |

|

|

| Foreclosure Charges | Zero foreclosure charges | Foreclosure charges applied |

| Application Approval Time | Instant Approval (Pre-approved credit limit up to Rs. 75000) | Application review & approval takes up to 3-5 days |

As can be seen, Ujjwal EMI Card has several benefits over credit cards. So, what are you waiting for? Apply for a Ujjwal EMI Card today and discover a whole new world of EMI shopping “without credit cards”!

संबंधित विषय

- Financial Products and Services

Can we Apply for Credit Card and Loan at the Same time?

If you are only concerned whether you can apply for a credit card and loan at the same time, then the answer is yes, you can!

- Financial Products and Services

Free Credit Report: Is It Really Free?

Nowadays, in and around the financial environment, every lender looks at your credit score before considering your borrower profile.

- Financial Products and Services

5 Reasons to Get a Small Business Loan

Whenever you’re considering a business loan, it’s quite common to hear different opinions on its application & use.

- Financial Products and Services

3 Top Credit Cards Available in India

Are you looking for a credit card to shop for your favorite items? Typically, the younger generation, office class likes to get the best cards for shopping & lifestyle in India.

- Financial Products and Services

5 Best Personal Finance Tools

A new year begins with the ray of hope for greater profitability & that your investments will only move positively.

- Financial Products and Services

Closing your Credit Card without hurting your Credit Score

Are you thinking to cancel your credit card? Before you think of cancelling your credit card, think twice!

- Financial Products and Services

What Are The Benefits of The Home Credit Ujjwal EMI Card?

We all have goals in life, whether it’s to buy the best smartphone to pursue our passion for photography or to buy the latest refrigerator for our mothers to proudly display in their kitchens.

- Financial Products and Services

8 Reasons To Apply Personal Loan From Home Credit

From time to time, we always have crucial decisions to make, and chances are that it will cost money!

- Financial Products and Services

Multiple Credit Cards: Good or Bad?

Having a credit card is a common financial tool that offers convenience and purchasing power. But what about having multiple credit cards?

- Financial Products and Services

How To Make the Most of Your Credit Card?

Today, we’re going to talk about credit cards, and how to make the most out of them.

- Financial Products and Services

Easy Financial Planning with a Personal Loan EMI Calculator

Managing finances is an integral part of our lives, and at times, unexpected expenses or opportunities may arise that require additional funds.

- Financial Products and Services

How To Choose The Right Credit Card?

In a world where financial transactions are increasingly digitized, credit cards have become an indispensable tool for managing our day-to-day expenses.

- Financial Products and Services

5 Things 'To Do' Before a Closing Credit Card

Don’t even think about canceling that card before you do these five things.

- Financial Products and Services

4 Tips to check before withdrawing Cash from Credit Card

Getting your first credit card can be exhilarating as it indicates you have finally arrived.