Pros and Cons of Long-Term Personal Loans

Personal loans are one of the most popular forms of borrowing, allowing individuals to obtain funds for various purposes, such as debt consolidation, home improvement, or unexpected expenses.

When it comes to personal loans, borrowers can choose between short-term and long-term loans, depending on their financial needs and preferences. In this blog, we will discuss the pros and cons of long-term personal loans, so you can make an informed decision when considering this borrowing option.

Pros of Long-Term Personal Loans:

Lower Monthly Payments

One of the most significant advantages of long-term personal loans is the lower monthly payments. Since the repayment period is longer, the loan amount is divided into smaller payments, which can be more manageable for borrowers on a tight budget.

Fixed Interest Rates

Long-term personal loans often come with fixed interest rates, which means that the interest rate stays the same

throughout the life of the loan. This can be

advantageous for borrowers who want to avoid the unpredictability

of variable interest rates.

Flexibility

Long-term personal loans offer flexibility in terms of repayment period, loan amount, and purpose. Borrowers can choose the repayment period that best suits their financial situation and can use the loan for various purposes, such as consolidating debt, home improvements, or covering unexpected expenses.

Build Credit History

If the borrower makes timely payments on the loan, it can help build their credit history, which can have a positive

impact on their credit score. A good credit

score can lead to better loan terms and interest rates in the

future.

Cons of Long-Term Personal Loans

Higher Interest Rates: Although long-term personal loans offer lower monthly payments, they often come with higher interest rates compared to short-term loans. This can result in higher overall interest charges and a more significant financial burden over time.

Longer Repayment Period

While a longer repayment period can be advantageous for borrowers on a tight budget, it also means that the borrower will be paying back the loan for a more extended period. This can result in a higher overall cost of the loan due to the additional interest charges.

Risk of Default

Since long-term personal loans require a more extended repayment period, there is a higher risk of default, which can negatively impact the borrower’s credit score and financial situation. It’s important to consider your ability to make timely payments over an extended period before taking out a long-term personal loan.

Prepayment Penalties

Some lenders may charge prepayment penalties if the borrower pays off the loan early. This can negate any potential savings from early repayment and limit the borrower’s ability to pay off the loan ahead of schedule.

Conclusion

Long-term personal loans can be a useful financial tool for individuals who need to borrow a significant amount of money over an extended period. However, it’s essential to weigh the pros and cons before deciding whether a long-term personal loan is right for you. Consider your ability to make timely payments, the total cost of the loan, and the potential impact on your credit score before making a decision. With careful consideration and responsible borrowing, a long-term personal loan can be an effective way to achieve your financial goals.

संबंधित विषय

- Financial Literacy

RBI Ki Fraud Ke Khilaf Ladai Mein Shaamil Hon: Bareilly Aur Pilibhit Mein Consumer Jagrukta Karyakram

Bharatiya upbhokta ke roop mein, aapke paas fraaud ke khilaf ladne ke bohot se adhikar hote hain aur Reserve Bank of India unhe surakshit rakhne ke liye ek RBI Consumer Awareness Program shuru kar raha hai. Kanpur ke RBI Ombudsman Office aapko jagrukta ke madhyam se shakti pradaan karna chahta hai.

- Financial Literacy

How to Build Your Credit Score from Scratch?

Your credit score is a critical aspect of your financial health.

- Financial Literacy

How to Get a Personal Loan for Self-Employed Individuals?

In today’s dynamic economy, more and more people are opting for self-employment as it offers flexibility and the opportunity to pursue one’s passion.

- Financial Literacy

Instant Personal Loan In 3 Easy Steps

Traditionally, extensive documentation, manual processes, multiple bank visits, endless paperwork, and a long wait for disbursal were a part of availing a personal loan.

- Financial Literacy

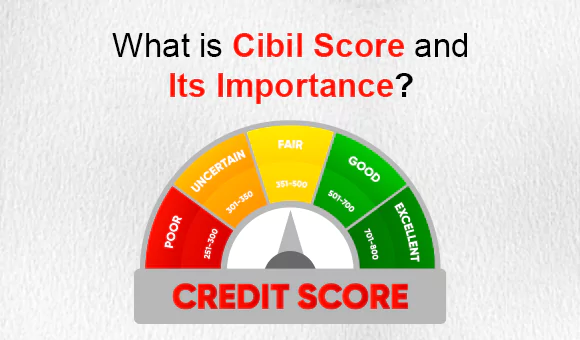

What is Cibil Score and Its Importance?

A CIBIL Credit report consists of all the particulars related to your borrowing history and the discipline of its repayment.

- Financial Literacy

All You Need to Know About Credit Score

Have you ever been wondering about what a credit score is? What’s all the big fuss about it? Understanding them will benefit you at some time in your life.

- Financial Literacy

Useful Tips for Personal Loan EMI Management

In today’s fast-paced world, personal loans have become an essential financial tool to meet various needs and aspirations.

- Financial Literacy

Does the Purpose of Personal Loan Affects Loan Approval?

When it comes to personal finance, taking a personal loan is often seen as a versatile solution to meet various financial needs.

- Financial Literacy

Personal Loans Vs. Mortgage: Choosing The Right Path To Financial Freedom

When it comes to achieving financial freedom, making the right choices about borrowing money can be a pivotal decision.

- Financial Literacy

पर्सनल लोन के ब्याज दर और कैलकुलेशन को समझें

पर्सनल लोन आपके बड़े खर्चों या आपातकालीन जरूरतों को पूरा करने का एक शानदार तरीका हो सकता है, लेकिन क्या आप जानते हैं कि इसका ब्याज कैसे कैलकुलेट किया जाता है? यह उतना जटिल नहीं है जितना आप सोचते हैं!

- Financial Literacy

5 Financial Lessons to Master by Age 30

Many lessons learned can be financially draining, take them all seriously to take critical financial decisions that may be skipped otherwise.

- Financial Literacy

3 Smart things to know before Co-Signing a Loan

When an instant loan is applied for both the co-signer and co-borrower are equally responsible for the loan taken.

- Financial Literacy

10 Things that Lower Your Credit Score

When it comes to your credit score, there are some things that can make it go down.