RBI Ki Fraud Ke Khilaf Ladai Mein Shaamil Hon: Bareilly Aur Pilibhit Mein Consumer Jagrukta Karyakram

Bharatiya upbhokta ke roop mein, aapke paas fraaud ke khilaf ladne ke bohot se adhikar hote hain aur Reserve Bank of India unhe surakshit rakhne ke liye ek RBI Consumer Awareness Program shuru kar raha hai. Kanpur ke RBI Ombudsman Office aapko jagrukta ke madhyam se shakti pradaan karna chahta hai.

Bareilly aur Pilibhit mein ek Consumer Jagrukta Karyakram aayojit kara jaa raha hain, jisme complaint redressal ka process aur fraud se bachne ke baare me zaruri tips saajha ki jayengi. bataya jayega.

Aap bhi is program mein aakar apne mushkil se kamaye hue paise ki suraksha ke tarike jaan sakte hain. Hum apne Home Credit parivaar ko is RBI Consumer Awareness program me aane ke liye invite karte hain aur aapko bhi fraud ke khilaaf is ladai me shaamil karte hain.

Consumer Awareness Program Ki Details

RBI Kanpur Ombudsman Office ek Consumer Awareness Programme (CAP) aayojit kar raha hai, jiske madhyam se complaint redressal ka process aur fraud se bachne ke surakshit tareekon ke baare mein jagrukta failayi jayegi.

Ye events Bareilly mein 01 June, 2023 ko aur Pilibhit mein 02 June, 2023 ko 2:30 baje se 5 baje tak aayojit kiya jayega.

Yeh hum sab ke liye ek important event hai jahan hum fraud se apne aap ko kaise bachayein, ye sikh sakte hain. Is event mein aapko kayi zaruri jaankari uplabdh karayi jayegi jaise:

- Fraud jaise phishing, vishing, SMS fraud, debit/credit card fraud, aadi se bachne ke liye aap kya savdhaniyan apna sakte hain, uske baare mein RBI madadgar salaah aur tips saajha karegi.

- Ek vyaparik seva upbhokta ke taur par aapke adhikar aur zimmedariyaan kya hain, iski jaankari bhi aapko is event me di jayegi.

Consumer awareness program ka aim hai RBI ke upbhokta suraksha framework ko majboot banana aur transparency badhana. Isme shamil ho kar aap apne paise ki suraksha ke liye zaroori gyaan prapt kar payenge.

In events ke registration ke liye aapko koi shulk nahi dena padega aur ye sabhi ke liye muft hai. Toh agar aap Bareilly ya Pilibhit mein rehte hain ya najdik hain, toh aap apne calendar ko block kar lijiye aur is programme ko zaroor attend kijiye. Hum sabhi ek sath milkar hi fraud ke khilaaf is ladayi mein jeet sakte hain aur apne aur apne janne walon ko isse surakhsit rakh sakte hain.

Aapko RBI Consumer Awareness Program Mein Kyun Shamil Hona Chahiye?

- Apne Aap Ko Fraud Surakshit Karne Ka Tarika Sikhein

Fraud karne ke tareeke har din advanced hote jaa rahe hain jiske wajah se wo aapke paise ya vyaktigat jaankari churane ke liye nayi taknikon ka istemal kar rahe hain. Is Upbhokta Jagrukta Karyakram mein shamil hokar, aap naye aur advanced tips sikhenge jinse aap apne aap ko aur apne paiso ko in khatron se surakshit rakh payenge. - Sawal Poochhein aur Jawab Paayein

Is tarah ke events mein shamil hona aapko aapke samuday ke logon se jodne ka mauka deta hai jo aapke chintaon ko saajha karte hain. Mil kar hum in pareshaniyon ko lekar jagrukta badha sakte hain, jankari baant sakte hain, aur ek doosre ka saath de sakte hain.

Fraud ke khilaf ladai ek teamwork ka prayaas hai aur is karyakram mein shamil hone waale har vyakti scams ko pehchaanne mein behtar taiyyar hoga, jankari dost aur pariwar ke saath bantega, aur samuday ko pure taur par surakshit banane mein sahayata kar payega.

RBI Ombudsman office ne is karyakram ka aayojan kiya hai taki woh nagrikon ko saksham banane mein sahayata kar sake aur aapko dhokhadhadi karne wale logon se aage nikalne ke liye sahaj upaay aur gyaan pradan kar sake.

Conclusion

Yeh aapka mauka hai apne mehnat se kamaye hue paise ko churane ki koshish karne wale fraudsters se bachne ka. Agar aap Bareilly ya Pilibhit mein rehte hain, to is jagrukta karyakram mein zarur shaamil ho jaiye, apne sawal poochiye, aur fraud se ladne ke naye tips seekhkar Fraud ko rokne ke liye taiyar ho jaiye.

संबंधित विषय

- Financial Literacy

Can’t find a guarantor for a loan? Here’s what your option

If we talk about a classic example, we should be able to go to the bank, submit our paperwork, and receive approval from them almost immediately – without any other detours.

- Financial Literacy

Aadhaar Virtual ID – How Safe is it?

You will now be using your Aadhaar virtual ID or VID similarly as you utilize your Aadhaar card details when it comes to banking operations, telecom organizations and so on.

- Financial Literacy

Virtual ID in the Real World

Have you heard about Virtual ID? UIDAI introduced Virtual IDs after facing concerns over security of users’ data.

- Financial Literacy

Credit Score – Facts & Myths

A credit score is a significant number for the lenders and borrowers, both. Along with the credit score, the credit report helps substantially o estimate the borrowing capacity of the prospects now and later.

- Financial Literacy

Reasons Why Instant Loans Help You Overcome Emergency Situations

Life is unpredictable; you never know what it may have in store for you.

- Financial Literacy

Aadhaar Virtual ID And its Benefits

Considering the protection of the individual information including the statistic and biometric data specified on the Aadhaar card, UIDAI has of late chosen to think of one of a kind element, named as Virtual Aadhaar ID.

- Financial Literacy

Why Are There Different Types Of Credit Scores?

The borrower’s credit history and trustworthiness become important criteria that help lenders decide whether to provide him or her with a loan or not when it comes to obtaining a collateral-free loan, whether it be a small business loan or a personal loan.

- Financial Literacy

अनचाहे कॉल से परेशान हैं? TRAI DND के साथ अपनी शांति वापस पाएँ!

आज के डिजिटल युग में, हमारे फ़ोन अपूरणीय हैं, लेकिन वे ढेरों अनचाहे कॉल और संदेश भी लाते हैं।

- Financial Literacy

How to Build Your Credit Score from Scratch?

Your credit score is a critical aspect of your financial health.

- Financial Literacy

How to Get a Personal Loan for Self-Employed Individuals?

In today’s dynamic economy, more and more people are opting for self-employment as it offers flexibility and the opportunity to pursue one’s passion.

- Financial Literacy

Instant Personal Loan In 3 Easy Steps

Traditionally, extensive documentation, manual processes, multiple bank visits, endless paperwork, and a long wait for disbursal were a part of availing a personal loan.

- Financial Literacy

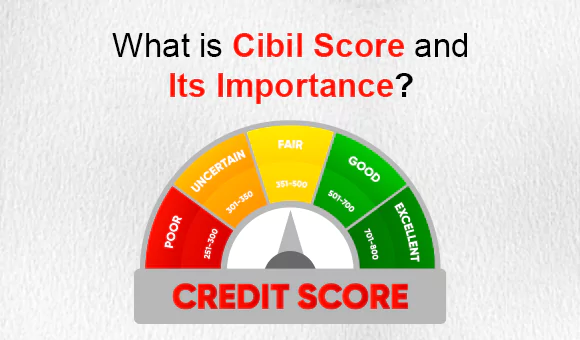

What is Cibil Score and Its Importance?

A CIBIL Credit report consists of all the particulars related to your borrowing history and the discipline of its repayment.

- Financial Literacy

All You Need to Know About Credit Score

Have you ever been wondering about what a credit score is? What’s all the big fuss about it? Understanding them will benefit you at some time in your life.

- Financial Literacy

Useful Tips for Personal Loan EMI Management

In today’s fast-paced world, personal loans have become an essential financial tool to meet various needs and aspirations.

- Financial Literacy

Does the Purpose of Personal Loan Affects Loan Approval?

When it comes to personal finance, taking a personal loan is often seen as a versatile solution to meet various financial needs.

- Financial Literacy

Pros and Cons of Long-Term Personal Loans

Personal loans are one of the most popular forms of borrowing, allowing individuals to obtain funds for various purposes

- Financial Literacy

Personal Loans Vs. Mortgage: Choosing The Right Path To Financial Freedom

When it comes to achieving financial freedom, making the right choices about borrowing money can be a pivotal decision.

- Financial Literacy

पर्सनल लोन के ब्याज दर और कैलकुलेशन को समझें

पर्सनल लोन आपके बड़े खर्चों या आपातकालीन जरूरतों को पूरा करने का एक शानदार तरीका हो सकता है, लेकिन क्या आप जानते हैं कि इसका ब्याज कैसे कैलकुलेट किया जाता है? यह उतना जटिल नहीं है जितना आप सोचते हैं!

- Financial Literacy

5 Financial Lessons to Master by Age 30

Many lessons learned can be financially draining, take them all seriously to take critical financial decisions that may be skipped otherwise.

- Financial Literacy

3 Smart things to know before Co-Signing a Loan

When an instant loan is applied for both the co-signer and co-borrower are equally responsible for the loan taken.

- Financial Literacy

10 Things that Lower Your Credit Score

When it comes to your credit score, there are some things that can make it go down.