Virtual ID in the Real World

Have you heard about Virtual ID? UIDAI introduced Virtual IDs after facing concerns over security of users’ data. The concerns were raised over security of the users’ data as the Aadhaar number gets saved on whichever platform you put your Aadhaar number. Aadhaar number can be replicated and used anywhere without even letting the user know about it since it has all the details linked to it.

Catering to such genuine concerns, UIDAI launched Virtual IDs, a 16-digit number that can be created randomly by the users. A good thing about the newly introduced concept is that the number is temporary and if you create another one, the previous one gets deactivated. It is also said that a number is valid for a stipulated time. Therefore, it cannot be replicated or duplicated.

Also read: Know everything about Virtual Aadhaar ID and stop being cheated

How does virtual ID work?

Once you generate the ID on UIDAI website and fill in the desired details, it sends an OTP to the mobile number linked to your Aadhar number. You need to fill in the OTP received on your number to generate or retrieve your virtual ID. The safe part being that the VID is not flashed on your screen, it is sent to your registered mobile number therefore protecting it from someone else using it.

How is Aadhaar Virtual ID Different from Aadhaar Number?

First difference is the difference in digits it will be 16-digit whereas Aadhaar is 12-digit. VID will provide access to some specific information and won’t disclose the vital details, for eg. If you enter your virtual ID for verification it might only provide your photo, address or name to an authority whereas Aadhaar number has all your bank account details, phone number, etc. that is all personal and no user would want to disclose it under any condition as it can be misused.

VID is subject to cancellation or can be changed by the user if he/she feels apprehensive whereas Aadhaar once registered somewhere can be replicated and used illegally.

Further step taken by UIDAI to secure the Aadhaar details is ‘limited KYC’ that restricts the data disclosure of the users therefore ensuring security.

संबंधित विषय

- Financial Literacy

Can’t find a guarantor for a loan? Here’s what your option

If we talk about a classic example, we should be able to go to the bank, submit our paperwork, and receive approval from them almost immediately – without any other detours.

- Financial Literacy

Aadhaar Virtual ID – How Safe is it?

You will now be using your Aadhaar virtual ID or VID similarly as you utilize your Aadhaar card details when it comes to banking operations, telecom organizations and so on.

- Financial Literacy

Credit Score – Facts & Myths

A credit score is a significant number for the lenders and borrowers, both. Along with the credit score, the credit report helps substantially o estimate the borrowing capacity of the prospects now and later.

- Financial Literacy

Reasons Why Instant Loans Help You Overcome Emergency Situations

Life is unpredictable; you never know what it may have in store for you.

- Financial Literacy

Aadhaar Virtual ID And its Benefits

Considering the protection of the individual information including the statistic and biometric data specified on the Aadhaar card, UIDAI has of late chosen to think of one of a kind element, named as Virtual Aadhaar ID.

- Financial Literacy

Why Are There Different Types Of Credit Scores?

The borrower’s credit history and trustworthiness become important criteria that help lenders decide whether to provide him or her with a loan or not when it comes to obtaining a collateral-free loan, whether it be a small business loan or a personal loan.

- Financial Literacy

अनचाहे कॉल से परेशान हैं? TRAI DND के साथ अपनी शांति वापस पाएँ!

आज के डिजिटल युग में, हमारे फ़ोन अपूरणीय हैं, लेकिन वे ढेरों अनचाहे कॉल और संदेश भी लाते हैं।

- Financial Literacy

RBI Ki Fraud Ke Khilaf Ladai Mein Shaamil Hon: Bareilly Aur Pilibhit Mein Consumer Jagrukta Karyakram

Bharatiya upbhokta ke roop mein, aapke paas fraaud ke khilaf ladne ke bohot se adhikar hote hain aur Reserve Bank of India unhe surakshit rakhne ke liye ek RBI Consumer Awareness Program shuru kar raha hai. Kanpur ke RBI Ombudsman Office aapko jagrukta ke madhyam se shakti pradaan karna chahta hai.

- Financial Literacy

How to Build Your Credit Score from Scratch?

Your credit score is a critical aspect of your financial health.

- Financial Literacy

How to Get a Personal Loan for Self-Employed Individuals?

In today’s dynamic economy, more and more people are opting for self-employment as it offers flexibility and the opportunity to pursue one’s passion.

- Financial Literacy

Instant Personal Loan In 3 Easy Steps

Traditionally, extensive documentation, manual processes, multiple bank visits, endless paperwork, and a long wait for disbursal were a part of availing a personal loan.

- Financial Literacy

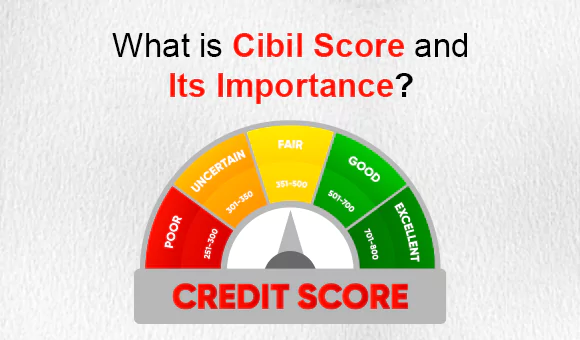

What is Cibil Score and Its Importance?

A CIBIL Credit report consists of all the particulars related to your borrowing history and the discipline of its repayment.

- Financial Literacy

All You Need to Know About Credit Score

Have you ever been wondering about what a credit score is? What’s all the big fuss about it? Understanding them will benefit you at some time in your life.

- Financial Literacy

Useful Tips for Personal Loan EMI Management

In today’s fast-paced world, personal loans have become an essential financial tool to meet various needs and aspirations.

- Financial Literacy

Does the Purpose of Personal Loan Affects Loan Approval?

When it comes to personal finance, taking a personal loan is often seen as a versatile solution to meet various financial needs.

- Financial Literacy

Pros and Cons of Long-Term Personal Loans

Personal loans are one of the most popular forms of borrowing, allowing individuals to obtain funds for various purposes

- Financial Literacy

Personal Loans Vs. Mortgage: Choosing The Right Path To Financial Freedom

When it comes to achieving financial freedom, making the right choices about borrowing money can be a pivotal decision.

- Financial Literacy

पर्सनल लोन के ब्याज दर और कैलकुलेशन को समझें

पर्सनल लोन आपके बड़े खर्चों या आपातकालीन जरूरतों को पूरा करने का एक शानदार तरीका हो सकता है, लेकिन क्या आप जानते हैं कि इसका ब्याज कैसे कैलकुलेट किया जाता है? यह उतना जटिल नहीं है जितना आप सोचते हैं!

- Financial Literacy

5 Financial Lessons to Master by Age 30

Many lessons learned can be financially draining, take them all seriously to take critical financial decisions that may be skipped otherwise.

- Financial Literacy

3 Smart things to know before Co-Signing a Loan

When an instant loan is applied for both the co-signer and co-borrower are equally responsible for the loan taken.

- Financial Literacy

10 Things that Lower Your Credit Score

When it comes to your credit score, there are some things that can make it go down.