Credit Score – Facts & Myths

A credit score is a significant number for the lenders and borrowers, both. Along with the credit score, the credit report helps substantially o estimate the borrowing capacity of the prospects now and later. Let’s switch quickly to the facts & myths now.

As discussed, the credit score reflects upon your qualification for a personal loan. On one hand, a good score can get a considerable loan amount and on the other a bad score can be held responsible for an instant loan rejection/ accept high interest loan. So, its visible to say that a lot rests at stake according to the credit report/ score. In fact, many important decisions lay on this one report to facilitate lenders at required times. Also, as a responsible borrower you must possess knowledge of what is a credit report and what are the contents of it. This will only help to keep your credit history intact and take measures to make corrective changes.

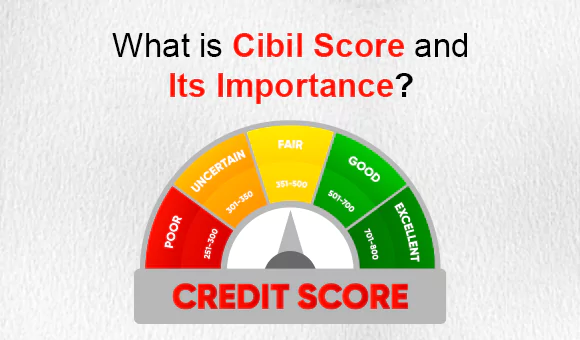

What do you actually understand by a Credit Score?

A credit score is a numerical digit which keeps track of your financial doings per se. You arrive at this score after taking into account different parameters like the financial behavior, repayment history, loan sanctioned, preferred loan type, defaults & penalties. The score remains within the bracket of 300-900. Conventionally, a score over 800 is considered ideal for lending institutions and acceptable for granting a credit card/ personal loan. In fact, a score above 750 is quite decent as well. Now, a score between 600-700 may not significantly be understood well. This evidently shows that you could not keep up excellent financial management and hence landed into trouble. But if your score drops below 600, then it’s a signal that you failed at managing funds well and need immediate corrective measures. A low credit score can also lead to straight rejection of your personal loan application.

So, What Really Impacts Your Credit Score?

There is enough hue & cry about how your credit score gets impacted. Different factors are usually accountable for a bad/ good credit score. Let’s talk about the most common ones. Have a look below:

Default in EMI

Repayment defaults can be considered harmful for your credit score. It pretty much shows in your report that you erred in your credit transactions however a recent mistake will cost higher than an older one. The impact of the past transactions keep falling eventually.

Multiple Trials

When you need instant cash, you generally seek a credit card or personal/short term loans. For this, you check on different lending institutions. So, too many loan requests can negatively showcase your credit history, which thereby leads to poor credit score.

Types of Loans

The types of loans you already have determines your credit score. So if you’ve unsecure loans like credit card or personal loans, then your score will be further worsened. However, if you have car or home loans, then your score is reserved.

Outstanding Debt

If you’re growing on the outstanding debt, then your repayment liability is also increasing. After a certain point, your credit score gets really heavy.

Myths

There is a huge heap of misconceptions related to a credit score. Let’s a quick look at all of them right away:

Previous Record

If you have a record with the credit bureau, then it that doesn’t necessarily mean that you’ve gone wrong. All bureaus maintain ledgers with good or bad credit records.

Several Credit Cards

Even if you have many credit scores, it doesn’t mean that you will be help up. It is about how you use the credit that matters more. Many credit cards/ personal loans do not put you down. The best utilization of the credit is considered utmost.

Low Income

Your income has nothing to do with your Credit Score.

Age

Your age has nothing to do with the credit score.

संबंधित विषय

- Financial Literacy

Can’t find a guarantor for a loan? Here’s what your option

If we talk about a classic example, we should be able to go to the bank, submit our paperwork, and receive approval from them almost immediately – without any other detours.

- Financial Literacy

Aadhaar Virtual ID – How Safe is it?

You will now be using your Aadhaar virtual ID or VID similarly as you utilize your Aadhaar card details when it comes to banking operations, telecom organizations and so on.

- Financial Literacy

Virtual ID in the Real World

Have you heard about Virtual ID? UIDAI introduced Virtual IDs after facing concerns over security of users’ data.

- Financial Literacy

Credit Score – Facts & Myths

A credit score is a significant number for the lenders and borrowers, both. Along with the credit score, the credit report helps substantially o estimate the borrowing capacity of the prospects now and later.

- Financial Literacy

Reasons Why Instant Loans Help You Overcome Emergency Situations

Life is unpredictable; you never know what it may have in store for you.

- Financial Literacy

Aadhaar Virtual ID And its Benefits

Considering the protection of the individual information including the statistic and biometric data specified on the Aadhaar card, UIDAI has of late chosen to think of one of a kind element, named as Virtual Aadhaar ID.

- Financial Literacy

Why Are There Different Types Of Credit Scores?

The borrower’s credit history and trustworthiness become important criteria that help lenders decide whether to provide him or her with a loan or not when it comes to obtaining a collateral-free loan, whether it be a small business loan or a personal loan.

- Financial Literacy

अनचाहे कॉल से परेशान हैं? TRAI DND के साथ अपनी शांति वापस पाएँ!

आज के डिजिटल युग में, हमारे फ़ोन अपूरणीय हैं, लेकिन वे ढेरों अनचाहे कॉल और संदेश भी लाते हैं।

- Financial Literacy

RBI Ki Fraud Ke Khilaf Ladai Mein Shaamil Hon: Bareilly Aur Pilibhit Mein Consumer Jagrukta Karyakram

Bharatiya upbhokta ke roop mein, aapke paas fraaud ke khilaf ladne ke bohot se adhikar hote hain aur Reserve Bank of India unhe surakshit rakhne ke liye ek RBI Consumer Awareness Program shuru kar raha hai. Kanpur ke RBI Ombudsman Office aapko jagrukta ke madhyam se shakti pradaan karna chahta hai.

- Financial Literacy

How to Build Your Credit Score from Scratch?

Your credit score is a critical aspect of your financial health.

- Financial Literacy

How to Get a Personal Loan for Self-Employed Individuals?

In today’s dynamic economy, more and more people are opting for self-employment as it offers flexibility and the opportunity to pursue one’s passion.

- Financial Literacy

Instant Personal Loan In 3 Easy Steps

Traditionally, extensive documentation, manual processes, multiple bank visits, endless paperwork, and a long wait for disbursal were a part of availing a personal loan.

- Financial Literacy

What is Cibil Score and Its Importance?

A CIBIL Credit report consists of all the particulars related to your borrowing history and the discipline of its repayment.

- Financial Literacy

All You Need to Know About Credit Score

Have you ever been wondering about what a credit score is? What’s all the big fuss about it? Understanding them will benefit you at some time in your life.

- Financial Literacy

Useful Tips for Personal Loan EMI Management

In today’s fast-paced world, personal loans have become an essential financial tool to meet various needs and aspirations.

- Financial Literacy

Does the Purpose of Personal Loan Affects Loan Approval?

When it comes to personal finance, taking a personal loan is often seen as a versatile solution to meet various financial needs.

- Financial Literacy

Pros and Cons of Long-Term Personal Loans

Personal loans are one of the most popular forms of borrowing, allowing individuals to obtain funds for various purposes

- Financial Literacy

Personal Loans Vs. Mortgage: Choosing The Right Path To Financial Freedom

When it comes to achieving financial freedom, making the right choices about borrowing money can be a pivotal decision.

- Financial Literacy

पर्सनल लोन के ब्याज दर और कैलकुलेशन को समझें

पर्सनल लोन आपके बड़े खर्चों या आपातकालीन जरूरतों को पूरा करने का एक शानदार तरीका हो सकता है, लेकिन क्या आप जानते हैं कि इसका ब्याज कैसे कैलकुलेट किया जाता है? यह उतना जटिल नहीं है जितना आप सोचते हैं!

- Financial Literacy

5 Financial Lessons to Master by Age 30

Many lessons learned can be financially draining, take them all seriously to take critical financial decisions that may be skipped otherwise.

- Financial Literacy

3 Smart things to know before Co-Signing a Loan

When an instant loan is applied for both the co-signer and co-borrower are equally responsible for the loan taken.

- Financial Literacy

10 Things that Lower Your Credit Score

When it comes to your credit score, there are some things that can make it go down.