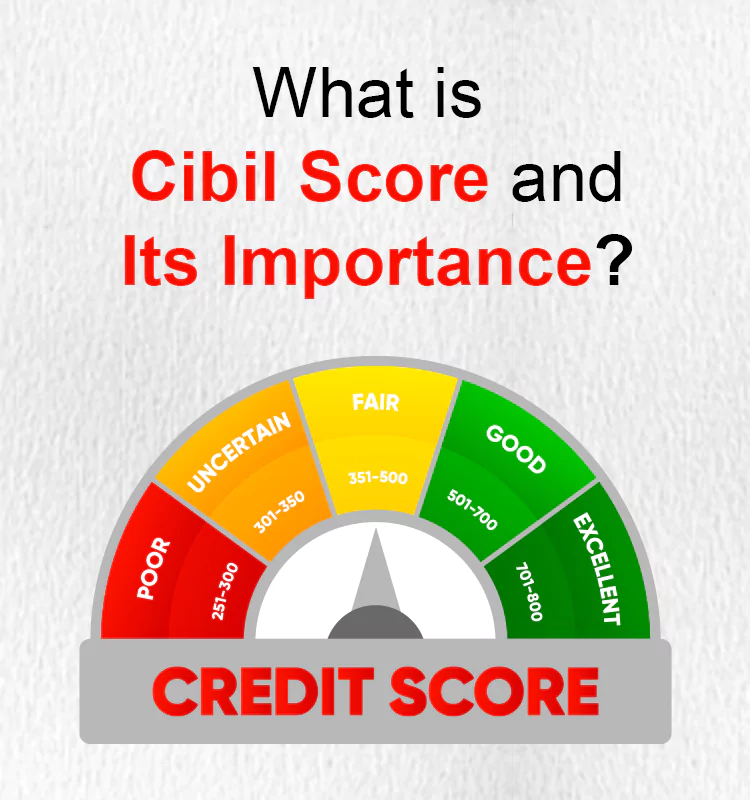

What is Cibil Score and Its Importance?

A CIBIL Credit report consists of all the particulars related to your borrowing history and the discipline of its repayment. Your CIBIL Score indicates financial stability and helps the lenders in deciding if lending to you is worth taking a risk or not. Simply speaking, CIBIL Score explains the probability of a borrower paying back the loan that was taken.

HOW ARE CIBIL SCORE CALCULATED?

CIBIL Scores are calculated based on various factors such as one’s payment history, number and type of loan accounts, length of one’s credit history. Once the CIBIL Score is calculated, it is sent to the banks and financial institutions for evaluation. Each bank or credit institution has its own benchmark that constitutes as a good score. It differs across banks.

WHY ARE CIBIL SCORE IMPORTANT?

CIBIL Scores are very important when it comes to availing credit, especially loan approvals. The banks check your CIBIL Score or credit score through CIBIL. A CIBIL score helps determine your creditworthiness which in turn will help you avail loans faster and easier.

When a borrower applies for a loan or a credit card at a bank or a financial institution, the lender checks the credit or the CIBIL Score first to determine if the applicant is eligible to avail the loan. The lender will not consider or reject an application if the CIBIL Score doesn’t meet their expectations or if its too low. But if the credit score is high, the lender will consider the application and move on to evaluate other factors before approving the application. Your CIBIL Score acts as the first impression for the lender. The higher the score, the better chances of the loan/ credit card being approved.

WHY IS CIBIL REPORT IMPORTANT?

A CIBIL report plays a prominent role in an individual’s financial journey. The lenders depend on your CIBIL report to verify an individual’s creditworthiness. The main purpose of a CIBIL Report is that it aids the lender as well as the borrower in identifying and understanding their credit history clearly and completely.

Purpose of a CIBIL Report :- A CIBIL Report helps to measure the ability of a borrower to repay the loan. The lenders refer the report and measure how much loan an individual currently has and if any loan can be taken further.

Most Important things you should know about CIBIL Report:

Decides the credibility: CIBIL Report describes the credibility of an individual. If you are an individual, who has managed to repay all the loans on time, you will have a good credit report.

Maintains a Monthly Record: CIBIL Report is based is based on the month on month details about the type of loans and the number of loans taken by an individual. It provides the entire credit related information of an individual.

Helps for Further Improvement: The CIBIL Report facilitates an individual to analyze the complete credit history and understand the scope of improvement in different areas.

Main component of CIBIL Report: A CIBIL Report essentially depicts the payment history of the loans belonging to an individual. It basically displays the exact portion of loan an individual has cleared and the current debt status of the individual.

ADVANTAGES OF GOOD CIBIL SCORE:

1. Ability to get a line of credit easily.

2. Quick approval for mortgages.

3. Low interest credit card

rates.

4. No security deposit on cell phones.

5. More negotiating power.

6. Get approved for

higher limits.

7. Low interest rate home loans and car loans.

CONCLUSION:

The loan market has well transformed in the last five years with the availability of individual credit information through CIBIL Report. Generally, the lenders look at CIBIL Report before deciding on a loan. If you have applied for a loan, you should know the important points that are related to the CIBIL Report.

संबंधित विषय

- Financial Literacy

RBI Ki Fraud Ke Khilaf Ladai Mein Shaamil Hon: Bareilly Aur Pilibhit Mein Consumer Jagrukta Karyakram

Bharatiya upbhokta ke roop mein, aapke paas fraaud ke khilaf ladne ke bohot se adhikar hote hain aur Reserve Bank of India unhe surakshit rakhne ke liye ek RBI Consumer Awareness Program shuru kar raha hai. Kanpur ke RBI Ombudsman Office aapko jagrukta ke madhyam se shakti pradaan karna chahta hai.

- Financial Literacy

How to Build Your Credit Score from Scratch?

Your credit score is a critical aspect of your financial health.

- Financial Literacy

How to Get a Personal Loan for Self-Employed Individuals?

In today’s dynamic economy, more and more people are opting for self-employment as it offers flexibility and the opportunity to pursue one’s passion.

- Financial Literacy

Instant Personal Loan In 3 Easy Steps

Traditionally, extensive documentation, manual processes, multiple bank visits, endless paperwork, and a long wait for disbursal were a part of availing a personal loan.

- Financial Literacy

All You Need to Know About Credit Score

Have you ever been wondering about what a credit score is? What’s all the big fuss about it? Understanding them will benefit you at some time in your life.

- Financial Literacy

Useful Tips for Personal Loan EMI Management

In today’s fast-paced world, personal loans have become an essential financial tool to meet various needs and aspirations.

- Financial Literacy

Does the Purpose of Personal Loan Affects Loan Approval?

When it comes to personal finance, taking a personal loan is often seen as a versatile solution to meet various financial needs.

- Financial Literacy

Pros and Cons of Long-Term Personal Loans

Personal loans are one of the most popular forms of borrowing, allowing individuals to obtain funds for various purposes

- Financial Literacy

Personal Loans Vs. Mortgage: Choosing The Right Path To Financial Freedom

When it comes to achieving financial freedom, making the right choices about borrowing money can be a pivotal decision.

- Financial Literacy

पर्सनल लोन के ब्याज दर और कैलकुलेशन को समझें

पर्सनल लोन आपके बड़े खर्चों या आपातकालीन जरूरतों को पूरा करने का एक शानदार तरीका हो सकता है, लेकिन क्या आप जानते हैं कि इसका ब्याज कैसे कैलकुलेट किया जाता है? यह उतना जटिल नहीं है जितना आप सोचते हैं!

- Financial Literacy

5 Financial Lessons to Master by Age 30

Many lessons learned can be financially draining, take them all seriously to take critical financial decisions that may be skipped otherwise.

- Financial Literacy

3 Smart things to know before Co-Signing a Loan

When an instant loan is applied for both the co-signer and co-borrower are equally responsible for the loan taken.

- Financial Literacy

10 Things that Lower Your Credit Score

When it comes to your credit score, there are some things that can make it go down.