Useful Tips for Personal Loan EMI Management

In today’s fast-paced world, personal loans have become an essential financial tool to meet various needs and aspirations. Whether it’s funding a dream vacation, managing medical expenses, or consolidating debt, personal loans offer a convenient way to access immediate funds. However, it is crucial to manage your personal loan EMI effectively to ensure timely repayment and maintain a healthy financial standing.

Useful Tips for Personal Loan EMI Management

Today, we will provide you with some valuable tips for personal loan EMI management, helping you stay on track and achieve your financial goals.

Understand your financial capability

Before applying for a personal loan, it is essential to assess your financial situation and determine how much EMI you can comfortably afford. Take into account your monthly income, expenses, and existing financial obligations. By doing so, you can ensure that your loan EMI fits well within your budget, preventing any financial strain in the future.

Opt for a shorter loan tenure

While longer loan tenures may seem tempting due to lower EMIs, they also mean paying more interest over time. If your financial situation permits, opt for a shorter loan tenure. Although this may increase your EMI amount, it will help you save a significant amount on interest payments and enable you to become debt-free sooner.

Create a monthly budget

Maintaining a monthly budget is essential for effective EMI management. Track your income and expenses diligently, ensuring that you allocate sufficient funds for loan repayment. Identify areas where you can cut back on unnecessary spending and prioritize loan EMI payments as a top financial commitment. A well-planned budget will help you stay disciplined and ensure timely repayment.

Set up automatic payments

To avoid the risk of missing or delaying loan EMI payments, consider setting up automatic payments through your bank account. This way, your EMI amount will be deducted automatically on the scheduled due date, eliminating the chances of oversight or forgetfulness. Automatic payments provide convenience and peace of mind, ensuring that your loan stays on track.

Make prepayments when possible

If you find yourself with surplus funds, consider making prepayments towards your personal loan. Prepayments can help reduce the principal amount and, subsequently, the overall interest burden. Before making any prepayments, check with your lender for any applicable prepayment charges or conditions. By reducing your outstanding loan balance, you can shorten the tenure or reduce your EMIs, providing long-term financial benefits.

Avoid multiple loan applications

While it’s important to compare loan offers, avoid submitting multiple loan applications simultaneously. Each loan application leads to a hard inquiry on your credit report, which can negatively impact your credit score. This approach will minimize the potential impact on your credit score.

Seek professional advice if needed

If you encounter financial difficulties or struggle to manage your loan EMIs, seek professional advice from a financial planner or credit counselor. They can provide personalized guidance, assist you in restructuring your loan, or offer strategies to improve your overall financial situation. Remember, there are experts available to help you navigate through challenging times, so don’t hesitate to reach out.

Conclusion

Effectively managing your personal loan EMIs is crucial for maintaining a healthy financial life. By understanding your financial capabilities, conducting thorough research, creating a budget, and considering prepayments, you can stay on track and successfully repay your loan. Remember to remain disciplined and seek professional assistance when needed. With these useful tips, you’ll be well-equipped to manage your personal loan EMIs and achieve your financial goals.

संबंधित विषय

- Financial Literacy

Can’t find a guarantor for a loan? Here’s what your option

If we talk about a classic example, we should be able to go to the bank, submit our paperwork, and receive approval from them almost immediately – without any other detours.

- Financial Literacy

Aadhaar Virtual ID – How Safe is it?

You will now be using your Aadhaar virtual ID or VID similarly as you utilize your Aadhaar card details when it comes to banking operations, telecom organizations and so on.

- Financial Literacy

Virtual ID in the Real World

Have you heard about Virtual ID? UIDAI introduced Virtual IDs after facing concerns over security of users’ data.

- Financial Literacy

Credit Score – Facts & Myths

A credit score is a significant number for the lenders and borrowers, both. Along with the credit score, the credit report helps substantially o estimate the borrowing capacity of the prospects now and later.

- Financial Literacy

Reasons Why Instant Loans Help You Overcome Emergency Situations

Life is unpredictable; you never know what it may have in store for you.

- Financial Literacy

Aadhaar Virtual ID And its Benefits

Considering the protection of the individual information including the statistic and biometric data specified on the Aadhaar card, UIDAI has of late chosen to think of one of a kind element, named as Virtual Aadhaar ID.

- Financial Literacy

Why Are There Different Types Of Credit Scores?

The borrower’s credit history and trustworthiness become important criteria that help lenders decide whether to provide him or her with a loan or not when it comes to obtaining a collateral-free loan, whether it be a small business loan or a personal loan.

- Financial Literacy

अनचाहे कॉल से परेशान हैं? TRAI DND के साथ अपनी शांति वापस पाएँ!

आज के डिजिटल युग में, हमारे फ़ोन अपूरणीय हैं, लेकिन वे ढेरों अनचाहे कॉल और संदेश भी लाते हैं।

- Financial Literacy

RBI Ki Fraud Ke Khilaf Ladai Mein Shaamil Hon: Bareilly Aur Pilibhit Mein Consumer Jagrukta Karyakram

Bharatiya upbhokta ke roop mein, aapke paas fraaud ke khilaf ladne ke bohot se adhikar hote hain aur Reserve Bank of India unhe surakshit rakhne ke liye ek RBI Consumer Awareness Program shuru kar raha hai. Kanpur ke RBI Ombudsman Office aapko jagrukta ke madhyam se shakti pradaan karna chahta hai.

- Financial Literacy

How to Build Your Credit Score from Scratch?

Your credit score is a critical aspect of your financial health.

- Financial Literacy

How to Get a Personal Loan for Self-Employed Individuals?

In today’s dynamic economy, more and more people are opting for self-employment as it offers flexibility and the opportunity to pursue one’s passion.

- Financial Literacy

Instant Personal Loan In 3 Easy Steps

Traditionally, extensive documentation, manual processes, multiple bank visits, endless paperwork, and a long wait for disbursal were a part of availing a personal loan.

- Financial Literacy

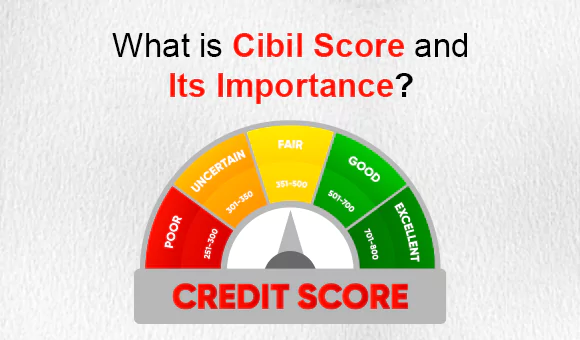

What is Cibil Score and Its Importance?

A CIBIL Credit report consists of all the particulars related to your borrowing history and the discipline of its repayment.

- Financial Literacy

All You Need to Know About Credit Score

Have you ever been wondering about what a credit score is? What’s all the big fuss about it? Understanding them will benefit you at some time in your life.

- Financial Literacy

Does the Purpose of Personal Loan Affects Loan Approval?

When it comes to personal finance, taking a personal loan is often seen as a versatile solution to meet various financial needs.

- Financial Literacy

Pros and Cons of Long-Term Personal Loans

Personal loans are one of the most popular forms of borrowing, allowing individuals to obtain funds for various purposes

- Financial Literacy

Personal Loans Vs. Mortgage: Choosing The Right Path To Financial Freedom

When it comes to achieving financial freedom, making the right choices about borrowing money can be a pivotal decision.

- Financial Literacy

पर्सनल लोन के ब्याज दर और कैलकुलेशन को समझें

पर्सनल लोन आपके बड़े खर्चों या आपातकालीन जरूरतों को पूरा करने का एक शानदार तरीका हो सकता है, लेकिन क्या आप जानते हैं कि इसका ब्याज कैसे कैलकुलेट किया जाता है? यह उतना जटिल नहीं है जितना आप सोचते हैं!

- Financial Literacy

5 Financial Lessons to Master by Age 30

Many lessons learned can be financially draining, take them all seriously to take critical financial decisions that may be skipped otherwise.

- Financial Literacy

3 Smart things to know before Co-Signing a Loan

When an instant loan is applied for both the co-signer and co-borrower are equally responsible for the loan taken.

- Financial Literacy

10 Things that Lower Your Credit Score

When it comes to your credit score, there are some things that can make it go down.